Property investment has long been considered one of the most stable and rewarding avenues for growing wealth. But in today’s economic climate where inflation, interest rates, and policy changes continue to shift landlords and investors must be more strategic than ever. Understanding the Return on Investment (ROI) is key to ensuring your rental property performs well.

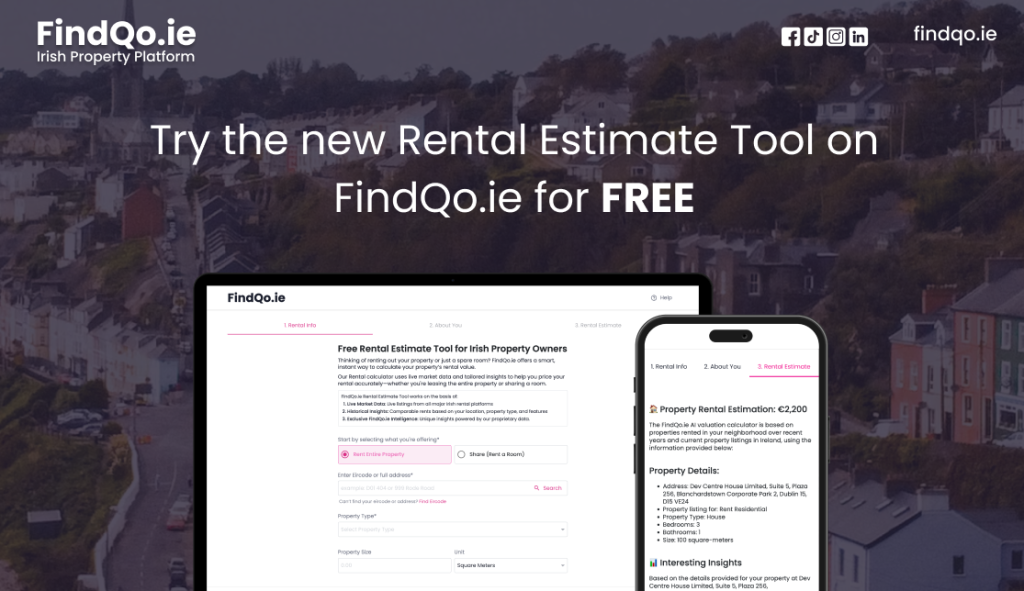

Whether you’re considering your first buy-to-let or expanding a portfolio, one question stands out: What’s the real ROI of renting out property in Ireland? This is where a rental estimate tool plays a vital role. With the right data and insights, you can go beyond guesswork and ensure your property not only earns but earns smartly. Let’s dive into how ROI works, what influences it in the Irish rental market, and how tools like FindQo.ie’s Rental Estimate Tool help you make more profitable decisions.

Understanding ROI in Property Rentals

Before exploring how to improve ROI, it’s essential to understand what it is. In property terms, ROI is the percentage of return you get on your rental income compared to the cost of the investment. It’s calculated using the formula:

ROI = (Net Annual Rental Income / Total Investment Cost) x 100

This includes:

- Purchase price of the property

- Stamp duty and legal fees

- Renovation and furnishing costs

- Ongoing expenses such as property management or maintenance

The goal is simple: maximise rental income while keeping costs under control. But in a market as dynamic as Ireland’s, predicting potential returns can be tricky unless you use a rental estimate tool to base decisions on real market performance.

How a Rental Estimate Tool Can Help Assess ROI

ROI isn’t just a post-purchase metric it should influence every step of the property investment journey. And here’s where the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits) becomes incredibly useful.

Rather than relying on generic averages or outdated listings, this tool gives you a precise rental income estimate, tailored to your property’s size, type, features, and location.

Built on AI-Powered Intelligence

FindQo.ie leverages AI-driven insights designed specifically for rental properties in Ireland. This means the tool doesn’t just pull listings; it learns from patterns across the Irish market to deliver estimates that reflect both current trends and long-term value.

Live Market Data from Leading Irish Platforms

What makes the rental estimate tool stand out is its use of live rental listings across all major Irish property portals. You’ll see what similar properties are advertising for right now, giving you a reliable benchmark to base your ROI calculations on.

Historical Data for Smarter Forecasting

It’s not just about the present FindQo.ie offers historical insights too. This includes past rental prices for properties like yours, so you can assess whether rental income is likely to increase or stabilise over time.

Exclusive Market Intelligence

The tool’s proprietary dataset goes beyond basic comparisons. It detects subtle patterns—such as seasonal price fluctuations, changing tenant preferences, and micro-market shifts—so you can predict ROI with more accuracy.

What Affects Rental ROI in Ireland?

To fully leverage the power of a rental estimate tool, it helps to understand what drives rental ROI in the Irish market:

1. Location

As with all things property-related, location is paramount. Dublin, Cork, and Galway tend to yield higher rental prices, but they also come with increased property prices. A tool like FindQo.ie helps identify value pockets areas where rents remain strong but purchase prices are more affordable.

2. Property Type and Features

One-bed apartments in urban centres may attract higher yields due to student and young professional demand. Meanwhile, three-bed homes in suburban areas might provide stable, long-term tenants. Features like secure parking, balconies, or energy-efficient appliances can also nudge rental prices upward.

3. Market Conditions

Rental demand fluctuates with job growth, university enrolment, and housing supply. During high-demand periods, rents climb, increasing ROI. But when the market softens, vacancy periods can drag down returns. The FindQo.ie tool helps anticipate these shifts by showing current and historical data together.

4. Upfront and Ongoing Costs

A key part of ROI involves keeping track of all costs purchase, furnishing, renovation, maintenance, insurance, and property tax. If a seemingly great rental price comes with high upkeep costs, your ROI may be less attractive.

Forecasting Future Returns with Confidence

One of the biggest concerns for landlords today is: Will my rental property remain profitable in the long run?

Here’s how the rental estimate tool helps de-risk the unknown:

- Compare your property to nearby listings in real time

- Track how similar properties have performed historically

- Adjust for seasonality and trends specific to your region

- Refine your pricing strategy to avoid long vacancies

This level of foresight is invaluable. A slight adjustment in rent based on live data could mean thousands in either missed income or reduced ROI if set incorrectly.

Case Example: Estimating ROI Using FindQo.ie’s Rental Estimate Tool

Imagine you’ve just purchased a two-bed apartment in Dublin for €375,000. After stamp duty and minor refurbishments, your total investment reaches €390,000.

You head to the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits), input your property details, and discover:

- Current comparable rent: €2,100/month

- Historical average: €2,050/month over the past 12 months

- Vacancy rate: Low

- Notable features in demand: Balcony and BER rating B2

Using this data:

Net Annual Income = (€2,100 x 12 months) – Expenses (€2,000) = €23,200

ROI = (€23,200 / €390,000) x 100 = 5.95%

This ROI is solid, especially in a high-demand area like Dublin. Better still, the tool alerts you that a nearby regeneration project could further boost future rents.

Why Use a Rental Estimate Tool Before You Buy?

Many investors wait until after purchase to look into rental yields but smart ones use tools like FindQo.ie before making any offer. That way, you’re buying with income clarity, not just hope.

This helps you:

- Avoid overpriced investments

- Spot under-valued areas

- Benchmark realistic rent expectations

- Negotiate better with sellers or agents

Even seasoned landlords can be caught off-guard by market shifts. A data-backed rental estimate tool reduces the guesswork and gives you the confidence to act faster and smarter.

Smarter Rentals Begin with Better Data

The ROI of renting property in Ireland can be impressive but only if you approach it with the right tools and data. In a market where demand, supply, and pricing shift constantly, your success as a landlord or investor depends on your ability to adapt.

The FindQo.ie Rental Estimate Tool provides exactly that adaptability. With live market data, historical insights, and AI-driven rental intelligence, it gives you a competitive edge in a rapidly evolving landscape.