Earning rental income in Ireland can be a solid source of passive income but it comes with tax responsibilities that many landlords overlook. Whether you’re letting out a second property, a former home, or even a room in your house, understanding how rental income is taxed is crucial.

And before setting your rent, knowing the fair market value is just as important. That’s where a rental estimate tool can help providing data-driven insights to ensure your pricing is competitive and realistic.

In this article, we’ll walk through the key tax implications of rental income in Ireland, what you can and can’t claim, and how to get an accurate rental valuation using an AI-powered rental estimate tool.

How Is Rental Income Taxed in Ireland?

All rental income earned in Ireland is considered taxable under self-assessment rules. This applies whether you’re an Irish resident or a non-resident landlord earning income from an Irish property.

Rental income must be declared to Revenue, and tax is calculated on your net rental income that is, your gross income minus allowable expenses.

Tax Rates That Apply

Rental income is taxed at your marginal rate. This means:

- 20% for income up to €42,000 (for individuals in 2025)

- 40% for income over that threshold

- Plus: PRSI (4%) and Universal Social Charge (USC), depending on your total income

So, if your rental income pushes your total income over the 40% tax bracket, expect a higher liability.

What Expenses Can You Deduct?

The good news is that landlords in Ireland can reduce their taxable rental income by claiming certain allowable expenses. These include:

- Mortgage interest (only for residential properties that meet registration rules)

- Letting agent and management fees

- Repairs and maintenance

- Insurance premiums

- Accountancy fees

- Advertising costs for finding tenants

- Wear and tear on furnishings (if not claimed under capital allowances)

To maximise your deductions, ensure you keep accurate records and receipts for all expenses.

What About Pre-Letting Expenses?

In many cases, landlords invest in the property before it is ever rented. However, pre-letting expenses are generally not deductible unless they fall within specific categories, such as advertising or letting fees directly related to securing the tenancy.

Revenue is strict in this area, so it’s worth seeking professional advice before trying to claim on renovation costs made before the first tenant moves in.

Do I Need to Register with the RTB?

Yes. If you’re letting a residential property, you must register the tenancy with the Residential Tenancies Board (RTB). Without this, you’re not eligible to deduct mortgage interest on your tax return.

Using a Rental Estimate Tool to Stay Compliant

One of the smartest ways to stay compliant and optimise your earnings is by setting a realistic, justifiable rent from the start. This is where a rental estimate tool becomes indispensable.

Setting your rent too high might lead to longer vacancies, while pricing too low means leaving money on the table. A reliable rental valuation also ensures you’re not drawing unwanted attention from Revenue if your figures seem unrealistic for the market.

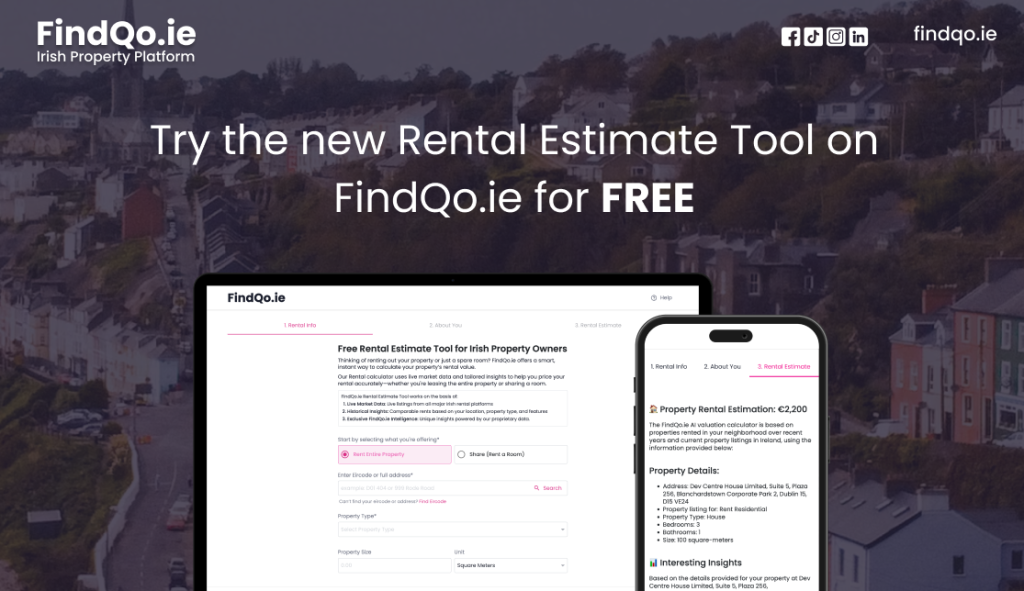

Introducing the FindQo.ie Rental Estimate Tool

If you’re seeking a modern, accurate, and user-friendly solution, look no further than the FindQo.ie Rental Estimate Tool.

This AI-powered tool is specifically designed for the Irish rental market and offers unparalleled insights for landlords, investors, and property managers.

Here’s what sets it apart:

🔹 Live Market Data

The tool scans real-time listings across all major Irish rental platforms, giving you up-to-date pricing based on properties just like yours.

🔹 Historical Insights

FindQo doesn’t just look at today’s data. It includes historical trends to show how similar properties in your area have performed over time taking into account location, property type, size, and key features.

🔹 Exclusive FindQo Intelligence

Built on proprietary AI algorithms, the tool provides unique market insights that go beyond basic averages. It helps uncover patterns and demand shifts that other calculators miss.

Use the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits)

Tax for Non-Resident Landlords

If you live abroad but rent out property in Ireland, you still have to pay Irish tax on your rental income. Here’s how it typically works:

- Your tenant or letting agent must withhold 20% of the gross rent and send it to Revenue.

- You can then claim that amount as a credit when filing your Irish tax return.

- You’re still entitled to the same allowable expenses.

Note: Revenue has introduced tighter controls and increased scrutiny on overseas landlords, so it’s more important than ever to ensure compliance.

Filing and Deadlines: What You Need to Know

Rental income must be included in your annual self-assessment tax return, known as the Form 11.

Key deadlines:

- 31 October (paper return)

- Mid-November (ROS e-filing, exact date varies)

Late filings can lead to penalties and interest, so don’t leave it to the last minute especially if you have multiple properties.

Tips for Landlords to Stay Tax-Efficient

- Track expenses year-round using digital tools or accounting software.

- Revisit your rent annually using a rental estimate tool to ensure you’re aligned with the current market.

- Work with a tax advisor particularly if you own multiple properties or are a non-resident.

- Register all tenancies with the RTB to claim allowable deductions.

- Reinvest wisely by understanding demand and trends in your area with AI tools like FindQo.

Smart Tools and Smarter Tax Planning

Managing rental property in Ireland means balancing income potential with tax obligations. With the right knowledge and the right tools you can stay compliant, make better decisions, and maximise returns.

A rental estimate tool like the one from FindQo.ie helps ensure you’re charging a fair market rent, staying competitive, and making decisions based on real insights not guesswork.

Try the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits)

It’s your first step to understanding market value, attracting the right tenants, and navigating the complexities of rental income with confidence.