In 2025, the question on many people’s minds is this: should I rent or buy in Ireland? With housing costs rising, mortgage rates shifting, and availability fluctuating across the country, knowing the right move isn’t always straightforward.

Whether you’re a first-time buyer eyeing up a long-term investment or a renter seeking flexibility, making the right housing decision in Ireland today requires balancing personal priorities with practical insights. In this guide, we’ll weigh up the pros and cons of renting vs buying in Ireland in 2025, helping you make the smartest move for your future.

Understanding the Housing Landscape in Ireland (2025)

Before diving into the rent vs buy debate, it’s important to look at Ireland’s current property market.

Over the last decade, Ireland has experienced significant changes in housing supply, price trends, and rental demand. Dublin remains the most expensive city for both renters and buyers, while regions like the Midlands, Limerick, and parts of the West offer more affordable alternatives.

Key 2025 housing facts:

- Mortgage interest rates have stabilised compared to previous years.

- Rental prices remain high, especially in urban centres.

- New housing developments are increasing—but demand still outpaces supply in key locations.

With this context in mind, let’s break down the real cost, benefits, and trade-offs of buying a home in Ireland versus continuing to rent.

Buying a Home in Ireland: Is It the Right Time?

Buying a property can be a major financial milestone—but is it the right move in 2025?

Pros of Buying a Home in Ireland

- Long-term investment: Property values tend to rise over time, especially in growth areas.

- Mortgage stability: Once locked in, your monthly repayments are often lower than equivalent rent.

- Freedom to personalise: Owning means no landlord restrictions—you can renovate, decorate, and stay as long as you like.

- Government supports: First-time buyers may still qualify for help-to-buy schemes or shared equity incentives.

Cons of Buying a Home in Ireland

- High upfront costs: Deposit, legal fees, stamp duty, and valuation fees can add up quickly.

- Less flexibility: It’s not as easy to relocate once you’re tied to a mortgage.

- Ongoing maintenance: Repairs, upgrades, and upkeep are your responsibility.

- Market risk: Property prices can fluctuate depending on location and economy.

Thinking of buying? Get started by valuating your current property for free on FindQo.ie—a useful first step if you’re trading up or downsizing.

Renting in Ireland: Still a Smart Option?

With flexibility and lower entry costs, renting in Ireland continues to attract young professionals, students, and those in transitional phases.

Pros of Renting in Ireland

- Lower upfront costs: You usually only need a deposit and one month’s rent.

- Mobility: Ideal for people who may change jobs, cities, or countries.

- No maintenance costs: Landlords are responsible for repairs and upkeep.

- Try before you buy: Renting in a new area lets you test it out before committing to a purchase.

Cons of Renting in Ireland

- No equity: Your monthly rent builds no long-term ownership.

- Rent increases: Prices can go up, especially in high-demand areas.

- Less control: You may face restrictions on pets, décor, or subletting.

- Limited security: Landlords can choose not to renew your lease.

If you’re a landlord, FindQo.ie also lets you post two free ads at any time—making it easier than ever to reach quality tenants quickly and affordably.

Renting vs Buying in Ireland: A Side-by-Side Comparison

| Factor | Buying a Home | Renting a Property |

|---|---|---|

| Upfront Costs | High – deposit, legal fees, stamp duty | Low – deposit and first month’s rent |

| Monthly Payments | Mortgage payments, which may be lower | Rent, often higher and subject to increases |

| Long-Term Benefits | Builds equity and potential capital gain | No equity—purely an expense |

| Flexibility | Limited – selling takes time | High – easier to move |

| Maintenance | Homeowner’s responsibility | Landlord’s responsibility |

| Security | High – you own the property | Medium – subject to lease terms |

| Tax Benefits | Mortgage interest relief (in some cases) | Usually none |

So, Should You Rent or Buy in Ireland in 2025?

There’s no one-size-fits-all answer. Instead, ask yourself:

- How long do you plan to stay in the same area?

- Do you have the savings for a deposit and fees?

- Are you ready for the responsibility of ownership?

- Would you benefit more from the flexibility of renting?

If you’re planning to stay put for 5+ years and can afford the upfront costs, buying a home in Ireland in 2025 may be the better investment. However, if your career or lifestyle is still evolving, renting gives you the freedom to adapt with fewer commitments.

Extra Tips for 2025 House Hunters and Renters

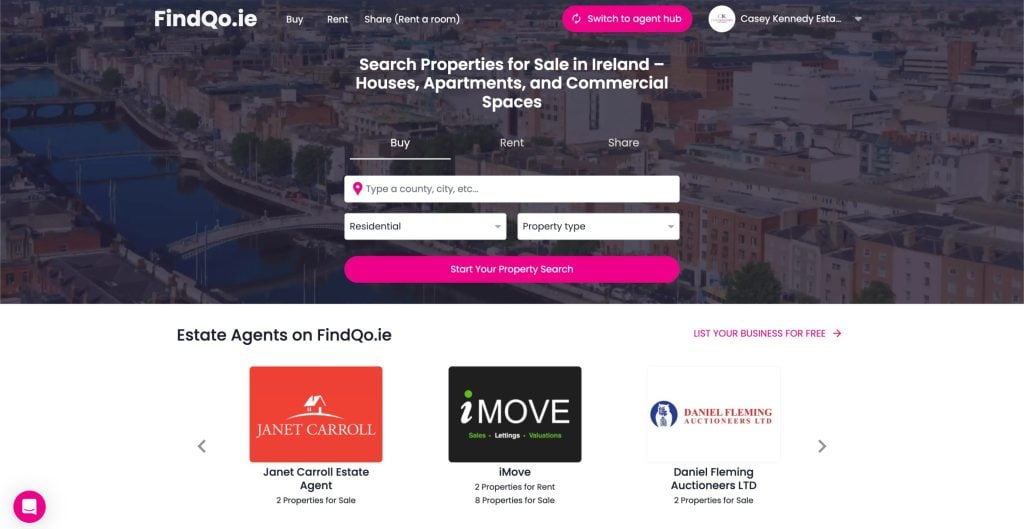

- Use trusted property platforms like FindQo.ie to browse listings, connect with landlords or estate agents, and manage your ads.

- Valuate your property for free if you’re planning to sell or swap.

- Keep an eye on mortgage offers from Irish banks and credit unions—some may offer competitive rates or cashback deals.

- Talk to a financial advisor before making big decisions—especially if you’re a first-time buyer navigating grants and tax implications.

Conclusion: Choose What Suits Your Life in Ireland Now

The choice between renting and buying in Ireland in 2025 ultimately comes down to your personal goals, finances, and timeline.

Want stability and investment potential? Buying could be the move. Need flexibility and lower upfront costs? Renting might suit you better for now.

Whatever you decide, make sure to explore your options with a clear head and use tools like FindQo.ie to simplify your journey, whether you’re a buyer, seller, or renter.