As a property investor, one of the most important metrics you need to understand is rental yield. It’s a key indicator that helps you assess the profitability of a rental property, allowing you to make informed decisions. Whether you’re a first-time landlord or a seasoned investor, understanding how to calculate rental yield can be the difference between a successful investment and one that fails to meet your financial goals.

In this blog post, we’ll explain how to calculate rental yield for your house, and how you can use tools like the FindQo.ie Rental Estimate Tool to determine the best rental price based on live market data, historical insights, and proprietary intelligence. Let’s dive in!

What is Rental Yield?

Before calculating rental yield, it’s important to understand what it is. Rental yield is a percentage that reflects the annual income generated from a rental property relative to its value. It’s one of the most common ways landlords and property investors assess the profitability of a rental property.

There are two types of rental yield:

- Gross Rental Yield: This is the rental income before accounting for any expenses, such as property management fees, maintenance costs, and taxes.

- Net Rental Yield: This takes into account all expenses and provides a more accurate reflection of the profitability of your rental property.

To calculate either type of rental yield, you need to know your property’s value and the annual rent it generates. Let’s break it down further.

How to Calculate Gross Rental Yield

To calculate your gross rental yield, you’ll use the following formula:

Gross Rental Yield = (Annual Rent / Property Value) x 100

Step-by-Step Guide to Gross Rental Yield Calculation:

- Determine the annual rent: Calculate how much rent your property generates over the course of a year. For example, if you charge €1,200 per month, your annual rent would be €14,400 (€1,200 x 12 months).

- Identify the property value: You’ll need to know the current market value of your property. This could be the purchase price if you’re just starting out, or the current market value if you’ve owned the property for some time.

- Apply the formula: Divide the annual rent by the property value and multiply the result by 100 to get your gross rental yield percentage.

For example, if your property is worth €200,000 and you receive €1,200 per month in rent, your gross rental yield would be:

Gross Rental Yield = (€14,400 / €200,000) x 100 = 7.2%

This means you’re making a 7.2% return on your investment each year before expenses.

How to Calculate Net Rental Yield

Net rental yield gives a more accurate reflection of your rental profitability as it factors in the expenses associated with owning and maintaining the property. These might include:

- Property management fees

- Maintenance and repairs

- Insurance

- Property taxes

- Mortgage interest

To calculate net rental yield, you can use the following formula:

Net Rental Yield = ((Annual Rent – Annual Expenses) / Property Value) x 100

Step-by-Step Guide to Net Rental Yield Calculation:

- Calculate your annual rent: As before, figure out how much you earn from rent each year.

- Add up your annual expenses: Sum up all costs associated with your property. For example, if you pay €2,000 annually in property management fees, €1,000 for maintenance, and €1,500 in taxes, your total annual expenses would be €4,500.

- Apply the formula: Subtract your annual expenses from your annual rent and then divide by the property value. Multiply by 100 to get your net rental yield.

For example, if your annual rent is €14,400, your expenses are €4,500, and your property value is €200,000, the calculation would be:

Net Rental Yield = ((€14,400 – €4,500) / €200,000) x 100 = 4.95%

This gives you a net rental yield of 4.95%, which reflects the actual return you are making after accounting for your expenses.

Why Rental Yield Matters

Rental yield is crucial for several reasons:

- Investment Comparison: Rental yield helps you compare the profitability of different rental properties. Higher yields indicate more profitable properties.

- Assessing Property Performance: It allows you to assess how well your property is performing compared to other investments, such as stocks or bonds.

- Identifying Opportunities: A higher rental yield can indicate that a property is priced well or that you can charge more rent for the property. On the other hand, low yields might suggest the property is overpriced or there’s room for rent increases.

- Financial Planning: Knowing your rental yield helps you plan for future investments. If your rental yield is low, you might need to explore upgrades to increase the value of the property or raise rent.

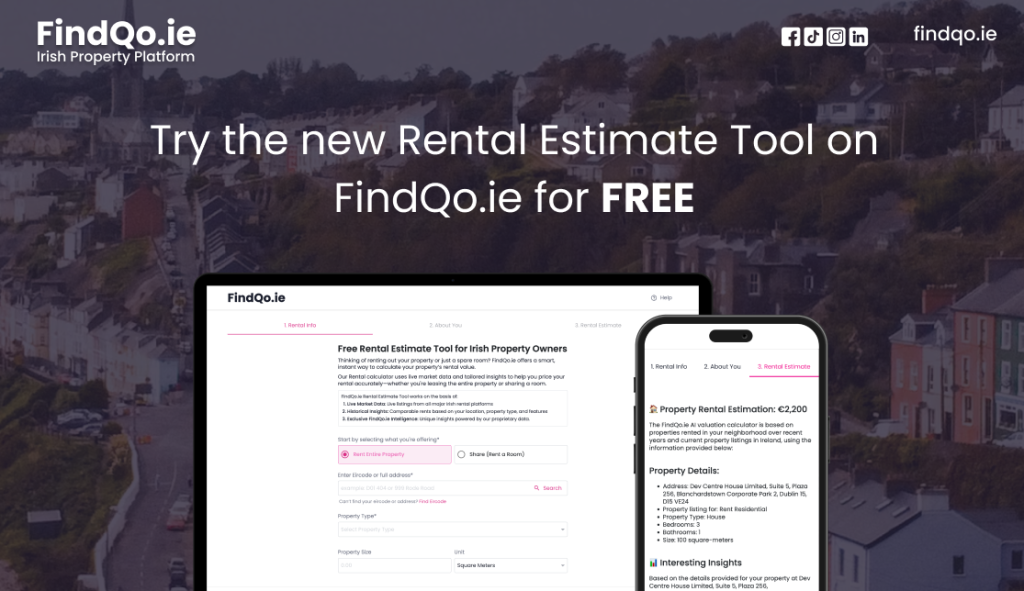

How the FindQo.ie Rental Estimate Tool Can Help You

Calculating your rental yield is only one part of the equation. You also need to know what rent to charge to maximise your return. This is where the FindQo.ie Rental Estimate Tool comes in.

The FindQo.ie Rental Estimate Tool provides you with:

1. Live Market Data

It gathers live listings from all major Irish rental platforms to help you understand current market trends and what similar properties are renting for in your area. This data can guide you in setting the right rent for your property to ensure you’re not overpricing or underpricing.

2. Historical Insights

The tool also provides historical data on comparable rents, giving you a clear picture of rent trends for properties like yours. This can help you predict future rent prices and better understand how the market has evolved over time.

3. Exclusive FindQo.ie Intelligence

In addition to live market data and historical trends, the FindQo.ie Rental Estimate Tool offers unique insights powered by proprietary data. These insights give you a more tailored estimate based on your property’s location, type, and features. By factoring in these elements, you can optimise your rental yield.

Using these insights, you can confidently set a competitive rental price that maximises your yield.

Try the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits)

Other Considerations for Maximising Rental Yield

While calculating and setting the right rent is crucial, there are other factors to consider when aiming to maximise your rental yield:

- Property Condition: Regular maintenance and upgrades can increase the appeal of your property, helping you charge higher rents.

- Tenant Quality: Attracting long-term, reliable tenants reduces vacancy periods and ensures consistent rental income.

- Location: The location of your property can have a huge impact on rental yield. Properties in high-demand areas typically offer higher yields.

- Tax Implications: Be aware of any taxes you may need to pay on rental income, as these can affect your net rental yield.

Calculating rental yield is essential for any landlord or property investor looking to evaluate the profitability of a property. By using the gross and net rental yield formulas, you can better understand your property’s financial performance.

To ensure that you’re setting the right rent and maximising your rental return, use the FindQo.ie Rental Estimate Tool. With live market data, historical insights, and proprietary intelligence, this tool helps you optimise your rental pricing strategy.

Access the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits)

By combining a solid understanding of rental yield with the insights from this powerful tool, you’ll be well-equipped to make informed decisions and maximise the profitability of your rental property.