Setting the right rent isn’t just about generating income it’s about protecting your investment and planning for long-term stability. Whether you’re a seasoned landlord or just starting out, understanding the core expenses that rent should cover is essential for staying financially sound and stress-free.

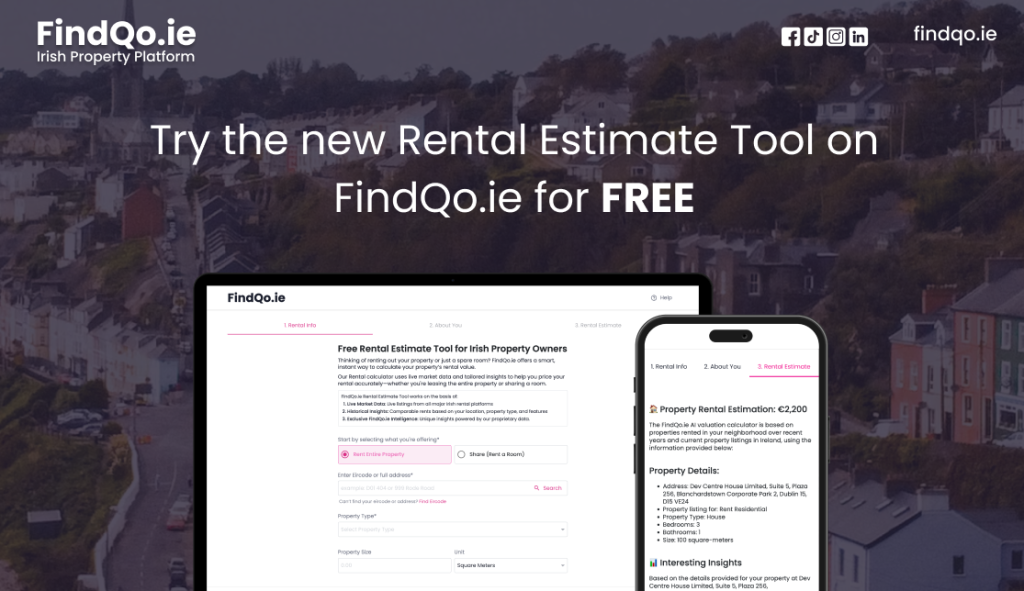

In this article, we’ll explore the key costs every landlord should account for, and how a rental estimate tool like the one offered by FindQo.ie can help you price your rental accurately using live Irish market data.

1. Mortgage Payments

If your property is financed through a mortgage, this will likely be your biggest monthly expense. Rent should comfortably cover:

- Interest payments

- Capital repayments (if you’re not on an interest-only loan)

- Potential future increases in interest rates (especially if on a variable-rate mortgage)

A shortfall here can quickly become a financial burden, so ensuring your rent reflects these obligations is crucial.

Not sure if your rent is aligned with the market? Use FindQo.ie’s rental estimate tool to receive a tailored estimate based on

real-time rental trends in your area.

2. Local Taxes and Charges

Rent should also account for recurring costs like:

- Local Property Tax (LPT)

- Waste management charges (if not covered by tenants)

- Service charges or management fees (especially in apartment complexes)

While individually modest, these add up and should be included in your rental pricing strategy.

3. Insurance Costs

Every rental property requires:

- Landlord insurance (to cover liability, damage, and rent loss)

- Contents insurance (for furnished properties)

Annual premiums can range from €300 to €1,000, depending on location, size, and risk factors. Failing to include this in your rent could lead to underestimating your break-even point.

4. Property Maintenance and Repairs

Unexpected issues are inevitable, from leaking taps to appliance failures. Experts suggest setting aside around 10% of monthly rent for general maintenance.

For example, a property renting at €1,500/month would warrant a monthly buffer of €150 for upkeep.

Wondering if your rent allows for this safety net? Simply visit FindQo.ie’s rental estimate tool, input your property details, and get an estimate in seconds. It’s quick, accurate, and built for Irish landlords.

5. Letting and Management Fees

If you’re using a letting agent or property manager, your rent needs to accommodate:

- A one-time letting fee (often 1–2 months’ rent)

- Ongoing management fees (typically 8–10% of monthly rent)

For a property earning €1,600/month, that’s up to €160 every month in management costs. Even if you self-manage, budget for your time and effort.

6. Vacancy Periods

Every landlord encounters vacancy gaps between tenants. Whether short or extended, it’s wise to account for a few weeks of unoccupied time per year in your budgeting.

Need help staying competitive in the market? The FindQo.ie rental estimate tool leverages live listings from Ireland’s top rental platforms to help you set a competitive price that minimises vacancy periods.

7. Compliance and Legal Requirements

Landlords in Ireland must adhere to legal standards, which may require payments for:

- BER certifications

- Gas safety inspections

- RTB (Residential Tenancies Board) registration

These costs vary but should be factored in to avoid non-compliance issues or fines. Rent should comfortably absorb these responsibilities.

8. Tax on Rental Income

You’ll need to pay income tax on your net rental profits after expenses. Depending on your overall earnings, tax can be as high as 40%, plus USC and PRSI.

Planning ahead by building your tax liability into your rent ensures you’re not caught off guard come tax season.

Why Accurate Pricing Matters

Failing to account for even one of these categories can eat into your returns. Over time, this can limit your ability to reinvest, maintain the property, or handle emergencies.

That’s why accurate rent pricing is so essential and why more landlords are turning to digital tools to guide them.

Looking to future-proof your rental income? Try FindQo.ie’s rental estimate tool today. It uses real-time market data, historical trends, and proprietary intelligence to deliver a personalized estimate for your property no guesswork required.

Setting rent isn’t just about matching what others are charging it’s about building a sustainable property business. Your rent should cover all essential costs: from mortgage and maintenance to taxes and compliance.

When in doubt, turn to data. FindQo.ie’s rental estimate tool takes the uncertainty out of pricing. Simply visit https://findqo.ie/rental-estimate-tool, enter your property details, and receive an accurate, data-backed estimate in seconds. It’s a small move that can make a significant impact on your long-term rental strategy.