When it comes to setting a rental price for your property, the decision can be more complex than simply comparing other listings in your area. As a property owner or investor, understanding the dynamics of the rental market can be crucial to maximise your returns. One question that often arises is whether to consider the rent-to-own model when pricing property.

Rent-to-own, also known as lease-to-own, offers tenants the opportunity to rent with the option to purchase the property at a later date. While this model is popular in some markets, how does it affect your property pricing? In this post, we’ll explore the pros and cons of rent-to-own agreements, how they can influence pricing, and how to use a rental estimate tool (free, no sign-up, no limits) to ensure you’re making an informed decision.

What is Rent-to-Own?

A rent-to-own agreement allows tenants to rent a property with the option to buy it later, typically within a certain time frame, often one to three years. A portion of the rent paid during the lease period is often credited towards the purchase price of the property. This option can be appealing to renters who may not have the immediate ability to purchase a home but aspire to do so in the future.

From a landlord’s perspective, offering a rent-to-own option can make your property more attractive, especially in areas where homeownership is a goal for many renters. It provides tenants with a sense of ownership without the immediate pressure of securing a mortgage.

How Does Rent-to-Own Affect Property Pricing?

When considering whether to incorporate rent-to-own options into your property pricing strategy, there are several factors to weigh. Here’s how it can influence your rental price:

- Higher Rent Potential

Rent-to-own agreements often allow landlords to charge a higher rent compared to traditional leases. This is because tenants are effectively paying for the opportunity to purchase the property in the future. The higher rent reflects the potential future value of the property and the portion of rent that will be credited toward the purchase. - Market Demand and Rent-to-Own Popularity

Rent-to-own is not universally appealing to all tenants. It’s important to assess the demand for rent-to-own in your area. In some markets, particularly in places where home prices are high, rent-to-own can be a great way to attract renters who would like to eventually purchase but can’t afford a down payment. However, in other areas, traditional renting may be more popular, and offering a rent-to-own agreement might not impact your rental pricing significantly. - Risk of Overpricing

One of the downsides of rent-to-own agreements is the potential to overprice the property. If you set the rent too high in an effort to account for the future purchase, you may turn off potential tenants. It’s crucial to balance the premium rent with competitive market rates. Pricing too high could result in a longer vacancy period, and the longer your property sits unoccupied, the more likely it is that your rental income will suffer.

How Can a Rental Estimate Tool Help?

When pricing your property, it’s essential to ensure that you’re not guessing the rental market demand. Instead, you need data-driven insights that reflect current trends and property values in your area. This is where a rental estimate tool comes in.

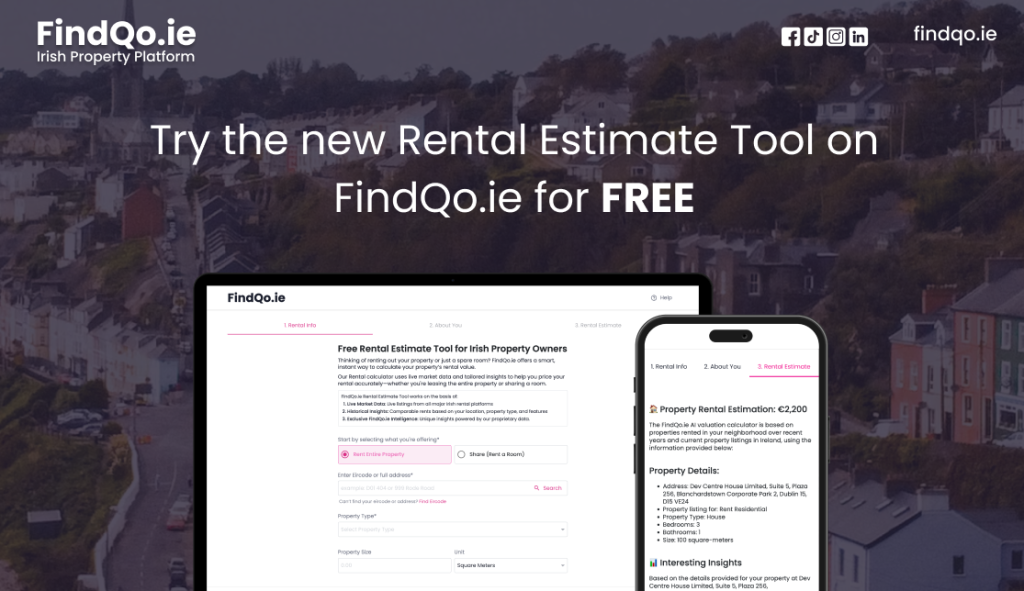

A rental estimate tool can give you a more accurate understanding of the fair market rent for your property, based on both live listings and historical data. The FindQo.ie Rental Estimate Tool is an excellent choice for Irish property owners, offering insights derived from AI-driven market data.

The FindQo.ie tool uses three key factors to provide highly accurate estimates:

- Live Market Data

The tool pulls in live listings from all major Irish rental platforms, offering up-to-date information about rental prices in your area. This data ensures you’re comparing your property with current rental prices, rather than relying on outdated or inaccurate information. - Historical Insights

Not only does the FindQo.ie tool use live data, but it also compares historical rents based on location, property type, size, and features like the number of bedrooms and proximity to amenities. This helps you understand how your property’s rental price compares to similar properties over time, ensuring your price is in line with the market. - Exclusive FindQo.ie Intelligence

Powered by proprietary AI technology, the FindQo.ie tool offers unique insights into market trends, tenant preferences, and future rental price movements. This intelligence helps you make informed decisions about pricing, ensuring you stay competitive while meeting tenant demand.

If you’re looking to evaluate your rental price based on real-time and historical data, the FindQo.ie Rental Estimate Tool is a great starting point. Best of all, it’s free, with no sign-up required and no limits to how often you can use it.

Try the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits)

Why Is Rent-to-Own a Smart Consideration for Some Landlords?

While there are potential risks in overpricing or misunderstanding market demand, rent-to-own can be an attractive option for many landlords. Here are a few reasons why:

- Attracting Long-Term Tenants

Rent-to-own tenants are typically more invested in their rental property since they have the option to buy it. This means they’re less likely to move out frequently, resulting in fewer vacancies and more stable rental income. - Higher Tenant Commitment

Because a portion of their rent is being credited toward the purchase, rent-to-own tenants often take better care of the property. This can reduce maintenance costs and make your property more appealing to future tenants or buyers. - Appealing to a Broader Audience

By offering rent-to-own options, you’re opening up your property to a broader audience, especially first-time homebuyers who may not currently qualify for a mortgage. This could help you reach a pool of renters who are willing to pay higher rents for the opportunity to eventually own a home.

Is Rent-to-Own Right for You?

Ultimately, the decision to offer a rent-to-own option depends on your property’s location, market demand, and your investment goals. While it can allow for higher rents and attract long-term tenants, it also carries the risk of overpricing and prolonged vacancies if not priced correctly.

To ensure you’re making the best decision, use tools like the FindQo.ie Rental Estimate Tool to evaluate your property’s market value. This will give you a clear understanding of how your property fits within current trends, whether you decide to stick with traditional renting or explore the rent-to-own option.

By leveraging data and market insights, you can make confident pricing decisions that maximise your rental income while attracting the right tenants.

Explore the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits)