If you’re a property owner in Ireland asking yourself, “How much should I invest to increase rental price?” you’re not alone. With rental markets shifting quickly and tenants becoming more selective, many landlords are exploring ways to maximise their returns. But the real question is: how do you know if the investment is worth it?

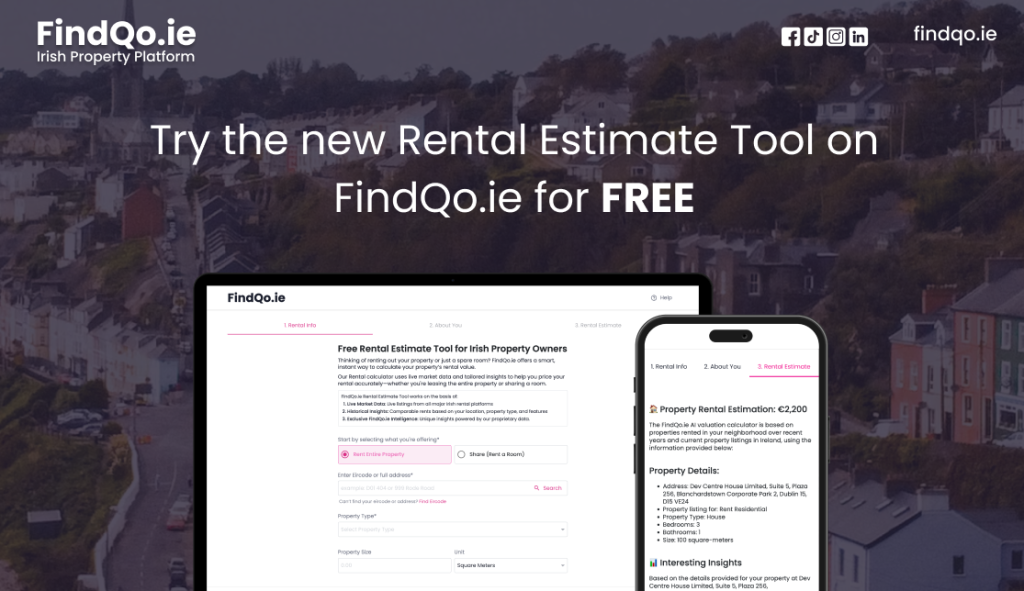

Enter the rental estimate tool a data-driven way to make smarter decisions. Rather than guessing what your property might earn post-renovation, tools like the one from https://findqo.ie/rental-estimate-tool offer real-time insights backed by market data, historical trends, and AI-powered intelligence. And yes it’s completely free, with no sign-up and no limits.

Let’s dive into what affects rental prices, how much to invest, and how the FindQo.ie Rental Estimate Tool can help you make confident, profitable upgrades.

Why Rental Price Matters More Than Ever

Setting the right rental price isn’t just about covering costs it’s about staying competitive in a dynamic market. A property that’s underpriced could cost you thousands annually. Overpriced? You might face longer vacancies.

So how can landlords strike the perfect balance? Data.

That’s where a rental estimate tool shines helping you understand where your property stands and how much potential it truly has.

What Factors Affect Rental Value?

Before making any investment, it’s important to understand what drives rent. Tenants today are looking for more than just four walls. Factors influencing rental value include:

- Location & Accessibility – Proximity to transport, schools, shops, and workplaces.

- Energy Efficiency – BER ratings are playing an increasing role, especially with rising utility costs.

- Modern Amenities – Think dishwashers, smart heating systems, or outdoor space.

- Size & Layout – Number of bedrooms and bathrooms still count, but so does usability.

- Overall Condition – Fresh paint, modern bathrooms, or new flooring can significantly lift appeal.

So, if you’re wondering whether to install a new kitchen or just repaint, a rental estimate tool can help you weigh the impact of each upgrade.

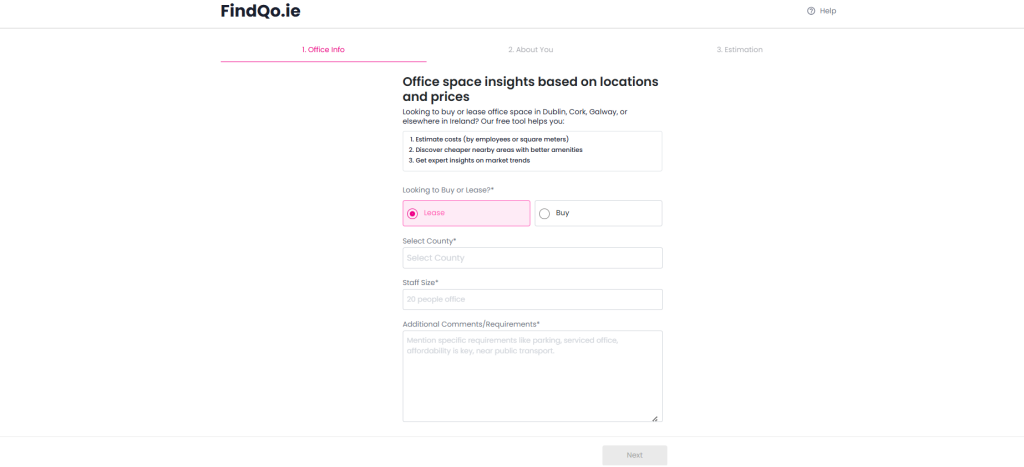

Introducing the FindQo.ie Rental Estimate Tool

What sets the FindQo.ie Rental Estimate Tool apart is its unmatched blend of live market data, historical pricing insights, and proprietary AI intelligence.

And best of all? It’s:

✅ Free to use

✅ No sign-up required

✅ Unlimited access

Here’s how it works:

🔹 Live Market Data

The tool aggregates listings from all major Irish rental platforms. Whether your property is in Dublin 4 or Salthill, you’re comparing your rent against what’s currently happening in the market right now.

🔹 Historical Insights

It also pulls historical rent trends based on your location, property type, features, and size. This ensures you’re not basing decisions on one-off listings, but on solid, comparative data.

🔹 Exclusive FindQo.ie Intelligence

This is where the magic happens. FindQo’s AI-driven models analyse thousands of data points rental performance by neighbourhood, seasonal trends, even demand surges to give you deeper insights that other tools might miss.

How Much Should You Invest to Boost Rent?

Now that you’ve got the right tool, let’s talk investment. The amount you should invest depends on your current rental value, local demand, and property type. Here’s a practical breakdown:

1. Low-Cost Improvements (Under €1,000)

- Fresh paint and minor touch-ups

- Deep cleaning or re-carpeting

- Upgraded lighting or fixtures

- Improved outdoor presentation (planters, fencing)

Rental uplift potential: 3–7%

2. Mid-Range Investments (€1,000–€5,000)

- New appliances (oven, washing machine)

- Bathroom upgrades (tiles, vanity, modern fittings)

- Enhancing energy efficiency (insulation, double glazing)

Rental uplift potential: 5–12%

3. High-Value Renovations (€5,000+)

- Full kitchen renovation

- Adding a bedroom or reconfiguring space

- Installing solar panels or heat pumps

Rental uplift potential: 10–20%, depending on location and demand

Not sure if a €10,000 kitchen will raise your rent by €200/month? The rental estimate tool lets you test different property features and see how they affect projected rental income.

Using the Rental Estimate Tool to Plan Upgrades

Here’s how to make the most of the FindQo.ie Rental Estimate Tool before you spend a cent:

Step 1: Visit the Tool

Go to https://findqo.ie/rental-estimate-tool no account needed.

Step 2: Input Property Details

Enter location, property type, number of rooms, and current features.

Step 3: Review the Estimate

You’ll get a rental range based on live and historical data tailored to your specific property.

Step 4: Add or Remove Features

Curious how adding a home office or new kitchen affects your rental price? Adjust the details and see how the estimate changes. It’s perfect for planning renovations that bring real value.

Avoid Overcapitalising: Let Data Lead the Way

While it’s tempting to go all-in on expensive upgrades, not all investments yield high returns. That’s why it’s essential to back every decision with data especially in regions where rental demand is steady but not explosive.

By using the FindQo.ie Rental Estimate Tool, you can avoid overcapitalising. Instead, focus on smart, targeted improvements with the greatest return.

Why Irish Landlords Are Turning to AI Tools

The Irish rental landscape is evolving fast. Between policy changes, rising interest rates, and shifting tenant expectations, it’s harder than ever to guess where the market is headed.

AI tools like FindQo.ie take the guesswork out of rental pricing. With reliable insights at your fingertips, you can:

- Price confidently

- Reduce vacant periods

- Prioritise cost-effective upgrades

- Stay ahead of market trends

Invest Smart, Not Blindly

Every euro you invest in your rental property should lead to better returns, but that only happens when you understand your property’s true earning potential. Whether you’re repainting or renovating, the FindQo.ie Rental Estimate Tool gives you the clarity and confidence to invest wisely.

So, before you pick up a paintbrush or call a contractor, ask yourself: What does the data say?

Because in today’s market, data-backed decisions aren’t optional they’re essential.