Determining the value of a house in Ireland involves a combination of market analysis, comparative research, and professional appraisal. Whether you’re a homeowner looking to sell, a buyer considering a purchase, or an investor evaluating opportunities, understanding how to calculate house value is crucial.

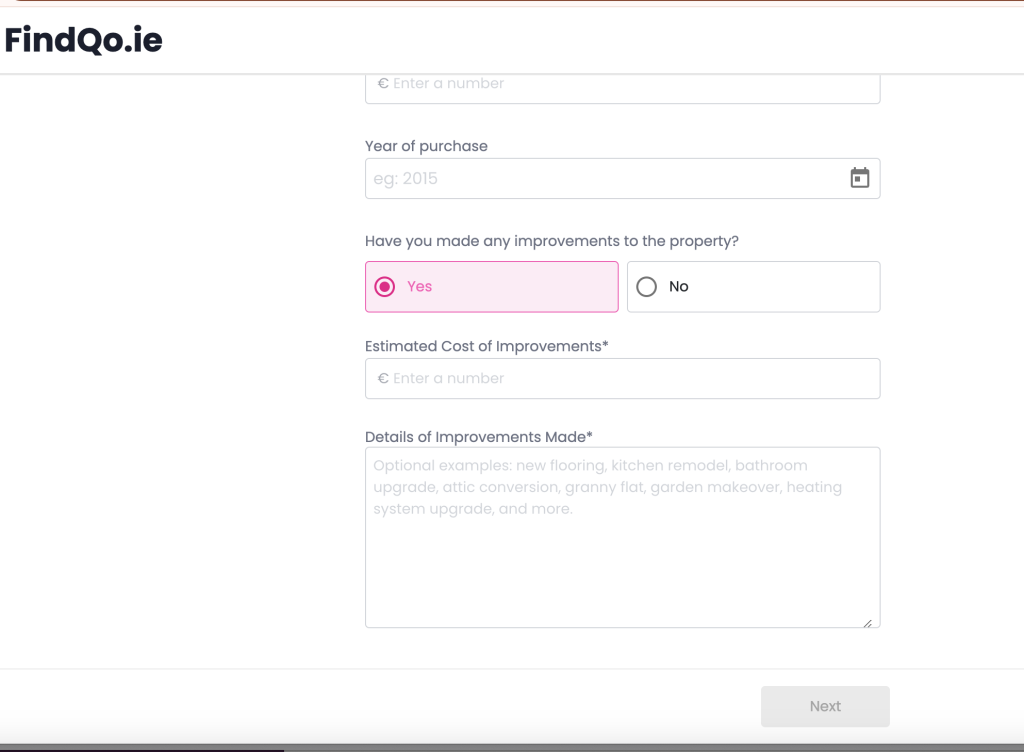

Free and Fastest way to get property valuation is using the FindQo Property Valuation tool here

Or, check this comprehensive guide to help you navigate the process:

1. Understand the Market Conditions

Before diving into specific calculations, it’s essential to understand the current real estate market conditions in Ireland. Factors such as economic trends, interest rates, and local demand can significantly impact property values.

- Economic Indicators: Keep an eye on economic indicators like GDP growth, employment rates, and consumer confidence.

- Interest Rates: Monitor the Central Bank of Ireland’s interest rates, as they can affect mortgage affordability and property demand.

- Local Demand: Research the demand for properties in your specific area, including factors like population growth and local amenities.

2. Comparative Market Analysis (CMA)

One of the most effective methods to calculate house value is through a Comparative Market Analysis (CMA). This involves comparing your property to similar homes that have recently sold in the same area.

- Identify Comparable Properties: Look for properties with similar characteristics, such as size, age, condition, and location.

- Recent Sales Data: Use reliable sources like the Property Price Register (PPR) to find recent sales data. The PPR provides detailed information on residential property transactions in Ireland.

- Adjust for Differences: Adjust the values of comparable properties to account for any differences between them and your property. For example, if a comparable property has an extra bedroom, you might adjust its value downward to match your property.

3. Professional Appraisal

Hiring a professional appraiser can provide a more accurate and detailed valuation. Appraisers use a combination of market data, property characteristics, and their expertise to determine the value.

- Chartered Surveyors: Consider hiring a chartered surveyor who is a member of the Society of Chartered Surveyors Ireland (SCSI). They follow strict guidelines and standards for property valuation.

- Report Details: A professional appraisal report will include details such as property description, market analysis, comparable sales, and the appraiser’s opinion of value.

4. Online Valuation Tools

Several online tools and platforms can provide a quick estimate of your property’s value. While these tools are convenient, they should be used as a starting point rather than a definitive valuation.

- Property Websites: Websites like Daft.ie, MyHome.ie, and PropertyPal.ie offer valuation tools based on market data and algorithms.

- Bank Valuations: Some banks provide free or low-cost valuation services, especially if you are considering a mortgage or refinancing.

5. Cost Approach

The cost approach estimates the value of a property based on the cost of replacing or reproducing it, minus depreciation, plus the value of the land.

- Replacement Cost: Estimate the cost of building a similar property today.

- Depreciation: Account for depreciation based on the property’s age and condition.

- Land Value: Assess the value of the land separately, often based on recent land sales in the area.

6. Income Capitalization Approach

For investment properties, the income capitalization approach can be useful. This method estimates the value based on the property’s potential to generate income.

- Gross Rental Income: Calculate the potential gross rental income.

- Operating Expenses: Subtract operating expenses to determine the net operating income (NOI).

- Capitalization Rate: Apply a capitalization rate (cap rate) to the NOI to estimate the property’s value. The cap rate is typically based on recent sales of similar investment properties.

7. Factors Affecting House Value

Several factors can influence the value of a house in Ireland. Understanding these factors can help you make more informed decisions.

- Location: Properties in desirable locations, such as near amenities, schools, and transportation, tend to have higher values.

- Size and Layout: The size of the property, including the number of bedrooms and bathrooms, and the layout can significantly impact the value.

- Condition: The overall condition of the property, including any recent renovations or updates, can affect its value.

- Market Trends: Current market trends, such as supply and demand, can influence property values.

- Economic Factors: Economic conditions, including employment rates and consumer confidence, can impact property values.

8. Seek Legal and Financial Advice

Before making any significant decisions based on your property valuation, it’s advisable to seek legal and financial advice. Professionals can provide guidance on tax implications, legal requirements, and financial planning.

- Legal Advisors: Consult with a legal advisor to understand any legal requirements or restrictions related to your property.

- Financial Advisors: Work with a financial advisor to understand the financial implications of buying, selling, or investing in property.

More info:

Calculating the value of a house in Ireland involves a combination of market analysis, comparative research, and professional appraisal. By understanding the market conditions, using comparative market analysis, hiring professional appraisers, leveraging online tools, and considering various valuation approaches, you can obtain a more accurate estimate of your property’s value. Additionally, seeking legal and financial advice can help you make informed decisions and navigate the complexities of the real estate market.

Don’t forget to try the FindQo AI Property Valuation tool

Check below the Screenshot of the FindQo Property Worth Calculator tool