For homeowners buyers and sellers, property valuation guides act as a decision making rather than just a reference number. When valuation is understood properly, it helps people decide when to move, when to wait, and how to plan next steps with confidence.

Instead of reacting to market noise, valuation allows decisions to be based on evidence. This is especially important in areas where prices fluctuate quickly or where demand changes street by street.

How Valuation Reduces Risk in Property Decisions

One of the most valuable roles of property valuation is risk reduction. For homeowners buyers and sellers, acting without clear valuation data can lead to overpaying, underselling, or mistiming the market. A data led valuation helps identify whether a decision is supported by real demand or driven by assumption.

By understanding current market value, buyers avoid stretching beyond fair pricing, while sellers reduce the risk of long listing periods caused by unrealistic expectations. Valuation grounded in local sales and live market data provides a safer foundation for every property move.

Why Comparable Sales Matter More Than Asking Prices

One of the most important elements in property valuation is comparable sales. Asking prices reflect expectations, but completed sales show what buyers were actually willing to pay.

Homeowners buyers and sellers benefit most when valuation focuses on recently sold properties within the same Eircode area. This removes guesswork and highlights true market behaviour rather than speculation.

How FindQo.ie Adds Clarity to Property Valuation

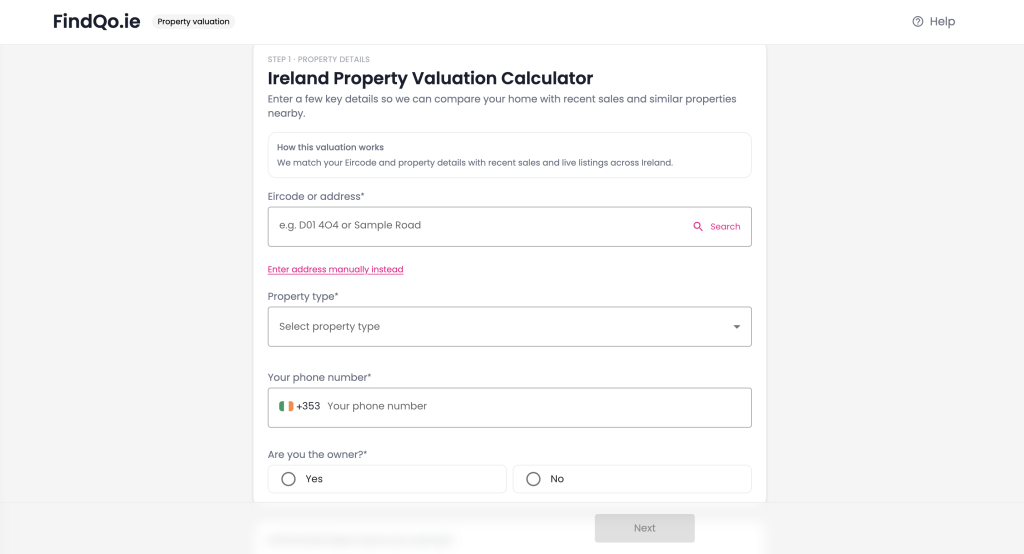

The FindQo.ie Property Valuation Calculator is designed to support clearer decision making. Using AI driven insights, it matches your Eircode and property details with recent sales and live listings across Ireland.

This approach produces a realistic valuation range instead of a single fixed figure. For homeowners buyers and sellers, this means understanding both current value and potential movement depending on market conditions.

Using Valuation to Plan Next Steps With Confidence

Property valuation also supports forward planning. Homeowners can use valuation insights to decide whether upgrading, downsizing, or refinancing makes sense. Buyers can assess how much flexibility they have in negotiations, while sellers can plan timelines based on realistic outcomes.

Tools like the FindQo.ie Property Valuation Calculator help bring this clarity together by analysing Eircode level data, recent sales, and live listings across Ireland. With clearer valuation insight, decisions become more strategic and less reactive.

Turning Valuation Insight Into Action

Accurate valuation only becomes useful when it informs action. Sellers can price strategically, buyers can negotiate with confidence, and homeowners can plan future moves based on real data.

With tools like FindQo.ie, property valuation becomes practical and accessible, helping users move forward with clarity rather than uncertainty.

Frequently Asked Questions

1. What does property valuation mean for homeowners buyers and sellers?

Property valuation provides a data led view of what a property is worth in the current market, helping homeowners plan, buyers assess value, and sellers price realistically.

2. Why are recent sales more important than asking prices?

Recent sales show what buyers have actually paid, while asking prices only reflect expectations. Valuations based on completed sales are more reliable.

3. How does Eircode improve valuation accuracy?

Eircode analysis allows valuation tools to focus on local market behaviour, capturing price differences between nearby streets and neighbourhoods.

4. Can valuation change depending on market timing?

Yes. Buyer demand, supply levels, and seasonal trends can all influence valuation outcomes, even for similar properties in the same area.

5. How does the FindQo.ie Property Valuation Calculator help?

FindQo.ie uses AI driven insights to match property details with recent sales and live listings across Ireland, providing a realistic valuation range rather than a fixed estimate.