With demand for housing in Dublin at an all-time high, it’s no surprise that property owners and landlords are asking, “How much rent can I charge in Dublin?” Whether you’re renting out a studio apartment in the city centre or a three-bed home in the suburbs, setting the right price can have a significant impact on your returns.

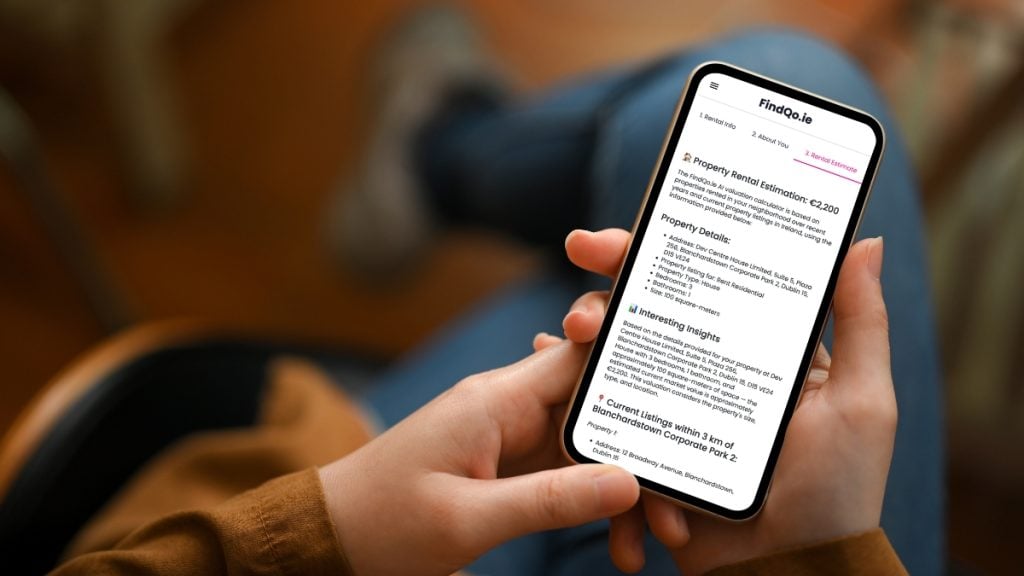

But instead of relying on assumptions or outdated property comparisons, smart landlords are now using data-powered solutions like the FindQo.ie Rental Estimate Tool a modern way to calculate your property’s potential based on real-time rental market data in Ireland.

In this guide, we’ll explore the average rental income in Dublin, what factors affect pricing, and how you can calculate your expected earnings using a rental estimate tool built specifically for the Irish market.

Why It’s Important to Get Your Pricing Right

Dublin’s rental market is competitive, and tenants have more options than ever before. Set your rent too high, and you risk longer vacancy periods. Set it too low, and you lose out on valuable income. Getting it just right requires understanding not only what your property offers but how similar properties are performing in the current market.

That’s where a rental estimate tool proves incredibly useful.

With it, you’ll get a precise range that reflects both average rental income in Dublin and how your specific property compares.

Average Rental Income in Dublin

Let’s start with a snapshot of what the current market looks like.

According to national housing data and property platform insights, here are the average monthly rents in Dublin (Q1 2024 estimates):

| Property Type | Average Monthly Rent |

|---|---|

| 1-Bed Apartment (City Centre) | €1,800 – €2,200 |

| 2-Bed Apartment (Suburbs) | €2,000 – €2,400 |

| 3-Bed House (Greater Dublin) | €2,400 – €2,800 |

| 1 Room in Shared House | €750 – €1,100 |

Keep in mind, these are general figures. Real value depends on location, condition, features, and demand. And because the market is always shifting, using a rental estimate tool allows you to stay accurate and up-to-date.

How to Accurately Calculate Rental Income in Dublin

So, how do you calculate what your own property can earn?

The most reliable way is by using a purpose-built rental valuation tool like the one offered by FindQo.ie. Here’s how it works:

What Powers the FindQo.ie Rental Estimate Tool

This is not just a simple calculator it’s an intelligent pricing engine built for landlords across Ireland, with specific value for Dublin’s unique rental landscape.

The rental estimate tool combines three layers of insight:

Live Market Data

It pulls listings from all major Irish rental platforms, offering real-time rental data for properties in your neighbourhood. This reflects what tenants are currently paying not just what others are asking.

Historical Insights

It analyses pricing trends based on your location and property type, giving you perspective on how prices have evolved. You can spot peak times, seasonal dips, and long-term shifts in rental value.

FindQo.ie Intelligence

This proprietary data layer includes:

- Tenant demand in your specific area

- Unique property features like parking, balconies, or high-speed broadband

- Local amenities such as schools, public transport, and proximity to business hubs

- Supply and demand shifts within your postcode

Together, these inputs create a tailored estimate that reflects how much rental income you can expect in Dublin, not just a national average.

Step-by-Step: Using the Rental Estimate Tool

Using the tool is fast and simple. Here’s what you do:

1. Input Your Property Details

Fill in your location, property type, number of bedrooms, and key features.

2. Let the Tool Analyse the Market

The system compares your data against similar properties in Dublin and analyses current listings and historical trends.

3. Get Your Estimate

You’ll receive a price range with supporting insights that can help guide your letting strategy.

Whether you’re letting your home for the first time or adjusting pricing for a new tenant, this tool gives you the clarity and confidence you need.

What’s the Rental Yield in Dublin?

If you’re an investor, you’ll also want to understand your rental yield that is, your annual rental income as a percentage of your property’s value.

Here’s a quick example:

- Property purchase price: €450,000

- Monthly rent: €2,300

- Annual rent: €27,600

- Rental yield = (27,600 / 450,000) × 100 = 6.13%

Using a rental estimate tool before buying or listing helps you plan more strategically, especially if you’re building a portfolio or comparing locations.

Take the Guesswork Out of Pricing Your Dublin Rental

With the Dublin rental market constantly shifting, setting the right rent has never been more important. An accurate price can help you attract quality tenants faster and maximise your returns without undervaluing your property.

Instead of relying on outdated listings or word-of-mouth comparisons, landlords can now make smarter decisions powered by data. The FindQo.ie Rental Estimate Tool combines:

- Up-to-date market listings

- Historical rent trends

- Location-specific insights tailored to Dublin’s rental landscape

If you’ve ever wondered, “How much rent can I charge in Dublin?”, this tool offers the clarity you need.

Ready to see what your property could earn?

Use the FindQo.ie Rental Estimate Tool and price your rental with confidence.