Inflation doesn’t just impact the cost of groceries or fuel it plays a significant role in the property market, too. For both landlords and tenants, understanding how inflation affects rent pricing is crucial in today’s volatile economic climate. But what if you could predict fair rent values quickly, accurately, and based on real-time trends?

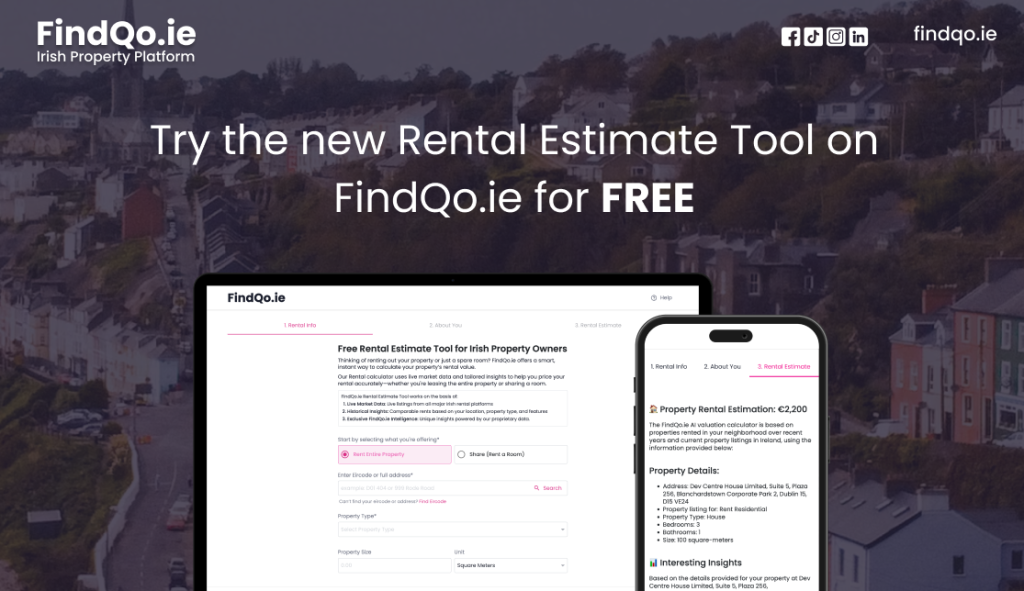

Enter the rental estimate tool, a digital solution changing the game for rental valuations in Ireland. In this article, we’ll explore how inflation drives rental price shifts, why accurate rent estimation is more important than ever, and how the FindQo.ie Rental Estimate Tool (free, no sign-up, no limits) can help you navigate the rental landscape with confidence.

Understanding Inflation’s Impact on Rent

Inflation refers to the general rise in prices across an economy, and it affects everything from consumer goods to utility bills and yes, rental properties. When inflation goes up, so do the costs of maintaining a property, from insurance and mortgage repayments to repairs and management fees. Landlords often respond to these rising costs by increasing rents.

But here’s the challenge: while landlords aim to preserve their return on investment, tenants are also feeling the pressure of higher living costs. This delicate balance makes accurate, data-backed rent pricing more vital than ever. That’s where a reliable rental estimate tool becomes invaluable.

Why Inflation Makes Rental Pricing More Complex

Let’s break it down. Inflation affects rent pricing through multiple channels:

- Rising property maintenance and service costs

- Increased demand as more people choose renting over buying

- Reduced housing supply, especially in urban areas

- Higher interest rates, which impact landlords with mortgages

These variables create a moving target for landlords trying to price fairly, legally, and competitively. An informed strategy must be based on current and historical data, not guesswork.

And that’s where FindQo.ie’s Rental Estimate Tool steps in to simplify it all.

Using a Rental Estimate Tool to Stay Ahead

A well-designed rental estimate tool doesn’t just spit out a number. It analyses key indicators to produce an estimate that’s both current and contextually accurate. In inflationary times, such tools are essential for making informed decisions.

Here’s how FindQo.ie’s Rental Estimate Tool (free, no sign-up, no limits) works and why it’s particularly valuable during periods of economic change.

Live Market Data

The tool collects and analyses real-time listings from Ireland’s top rental platforms. This ensures that your valuation reflects current market behaviour an essential factor when inflation is causing rapid pricing shifts.

When fuel prices rise, or energy bills spike, these changes ripple into the rental market. With live data, FindQo.ie’s tool helps landlords keep up with what tenants are actually paying right now, not what they were paying six months ago.

Historical Insights

While today’s data is key, understanding past trends provides crucial context especially when inflation spikes unexpectedly. FindQo.ie’s tool allows you to compare historical rental prices by property type, size, and location, giving you a better sense of how inflation has shaped your local market over time.

This is particularly helpful for landlords who want to track gradual rental growth or gauge the long-term impact of inflation on pricing strategy.

Exclusive FindQo.ie Intelligence

What truly sets this tool apart is its proprietary AI-driven intelligence. Unlike generic calculators, the rental estimate tool considers multiple data layers, including:

- Property condition and energy efficiency

- Neighbourhood desirability

- Internet and utility availability

- Historical market performance

- Seasonality trends

This in-depth analysis provides tailored, transparent rental estimates you can trust even in an unpredictable economy.

Pricing Too High or Too Low? The Risks of Guesswork

Inflation can tempt landlords to overprice, but without hard data, this strategy often backfires. Properties priced above realistic market levels may sit empty longer, leading to lost income. On the other hand, underpricing in a high-inflation environment could mean leaving significant revenue on the table.

A data-driven rental estimate tool gives you a clear benchmark, helping you avoid both extremes. It also offers something else: peace of mind. When you know your rent is in line with the market and backed by intelligent analysis you can move forward confidently, whether setting initial rent or planning a future increase.

How Tenants Respond to Inflation and Rent

Tenants are not immune to inflation’s impact. As living costs rise, renters become more price-sensitive and value-conscious. They’ll compare your property against others in the same area, weighing rent against features like:

- Energy ratings

- Proximity to public transport

- Internet speed

- Quality of fittings and finishes

In this context, accurate pricing can make or break a listing. If your property is priced fairly especially if it offers tangible value it stands a better chance of attracting responsible tenants quickly. Again, a rental estimate tool helps you hit this sweet spot.

Timing is Everything: When to Use a Rental Estimate Tool

Knowing when to reassess your rent is just as important as how you do it. Here are a few inflation-related scenarios when the FindQo.ie tool is especially useful:

- You’re about to renew a lease

- You’re listing a property for the first time

- Inflation rates have recently spiked

- You’ve upgraded your property

- Interest rates have changed

In all these cases, FindQo.ie’s Rental Estimate Tool (free, no sign-up, no limits) helps you price appropriately and competitively based on real data not guesswork.

Inflation, RPZs, and Legal Compliance

If your property falls within a Rent Pressure Zone (RPZ), inflation makes rent management even more complex. The Residential Tenancies Board (RTB) caps rent increases at 2% per year in RPZs, regardless of inflation rates. However, property upgrades or new tenancies can allow for rent reviews under specific conditions.

Using a tool that factors in both legal constraints and market dynamics ensures you’re compliant while staying profitable a delicate balance in high-inflation periods.