Free property valuation and asking price are often treated as the same thing, but for homeowners, the difference between the two is critical. Understanding how they work together, and why they are not interchangeable, can directly affect how successfully a property is sold and how confident decisions feel throughout the process.

In the Irish property market, where buyers are well informed and competition can vary by location, clarity around value has never been more important.

What Free Property Valuation Really Represents

A free property valuation is an estimate of what a home is worth in the current market based on data, not expectation. It reflects recent confirmed sales, comparable properties, and live listings in the same area.

For homeowners, this valuation acts as a reality check. It shows what buyers are actually paying for similar homes nearby, rather than what sellers hope to achieve. As a result, valuation provides a reliable starting point for planning, whether you are selling now or simply monitoring value over time.

How Asking Price Differs From Valuation

An asking price is a strategy, not a measurement. It is the price a seller chooses to bring a property to market, often influenced by demand, timing, and negotiation expectations.

Homeowners should understand that asking prices are sometimes set above valuation to allow room for offers. However, when the gap between asking price and valuation becomes too wide, buyer interest often drops. Today’s buyers compare listings closely and can quickly spot when a property appears overpriced.

Why the Gap Between Valuation and Asking Price Matters

The relationship between valuation and asking price has a direct impact on how a property performs on the market. Properties priced close to their valuation tend to attract more enquiries and stronger interest early on.

On the other hand, properties that start well above valuation may sit unsold, leading to price reductions later. In many cases, this results in a lower final sale price than if the home had been priced correctly from the start.

How the FindQo.ie Property Valuation Calculator Works

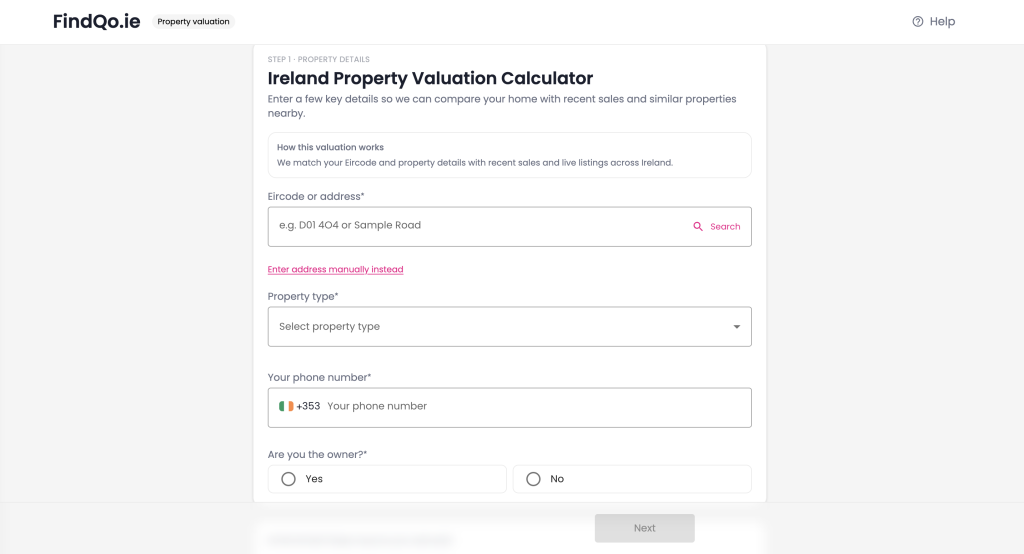

The FindQo.ie Property Valuation Calculator helps homeowners clearly understand this difference. Using AI driven insights, the tool matches your Eircode and property details with recent sales and live listings across Ireland.

Instead of providing a single fixed number, FindQo.ie delivers a realistic valuation range that reflects current market behaviour. This allows homeowners to see where their property sits before deciding on an asking price.

You can access the free valuation tool here:

How FindQo.ie Helps Homeowners Price Smarter

FindQo.ie supports homeowners by combining valuation insight with live market data. This makes it easier to compare similar properties, track value changes, and approach pricing with confidence.

By understanding both valuation and asking price, homeowners can avoid overpricing, reduce time on the market, and attract genuine buyers from the outset.

Final Thoughts

Free property valuation and asking price serve different purposes, but they work best when aligned. Valuation reflects market reality, while asking price reflects selling strategy.

For homeowners, using data led tools like FindQo.ie bridges the gap between the two, helping decisions feel clearer, more informed, and more effective in a competitive Irish property market.

Frequently Asked Questions

1. What is the difference between free property valuation and asking price?

A free property valuation reflects current market value based on recent sales and local data, while an asking price is a seller’s chosen price strategy.

2. Can a free property valuation help set the right asking price?

Yes. A valuation provides a realistic baseline that helps homeowners price their property more accurately.

3. Why do some homes sell below the asking price?

This often happens when the asking price is set above market value, leading to reduced interest and stronger negotiation from buyers.

4. Are online property valuation tools reliable in Ireland?

When based on recent confirmed sales, live listings, and Eircode data, they provide reliable valuation ranges for early decision making.

5. How does the FindQo.ie Property Valuation Calculator work?

FindQo.ie uses AI driven insights to match your Eircode and property details with recent sales and live listings across Ireland, delivering a realistic valuation range.