When it comes to selling a property, few things are more important than getting the price right. As a property seller, understanding your home’s market value is essential not just for attracting buyers, but for securing the best possible return on your investment.

Whether you’re preparing to list or simply exploring your options, using the right valuation tools and knowing the factors that influence property prices in Ireland can make all the difference. In this guide, we’ll walk you through how to accurately value your home, explain what goes into a valuation, and introduce a powerful tool that offers an instant estimate based on real-time Irish market data.

Why Accurate Property Valuation Matters for Every Property Seller

For any property seller, the journey starts with knowing your property’s worth. Overpricing can deter serious buyers and cause your listing to stagnate. On the other hand, undervaluing may lead to a quicker sale, but at the cost of thousands in lost profit.

With property markets fluctuating, and regional price differences becoming more pronounced across Ireland, using a property valuation guide Ireland resource becomes a necessity, not a luxury.

What Determines Your Property’s Value?

Valuing a home isn’t guesswork. Several core factors influence property pricing:

- Location: The town or city, proximity to amenities, schools, and transport links all influence price. For instance, Dublin properties typically fetch more than those in smaller towns.

- Size and Layout: Square footage, number of rooms, and overall flow of the property play a major role in perceived and real value.

- Condition and Age: Newly renovated homes or well-maintained older properties can attract higher valuations.

- Market Trends: Shifts in supply and demand, interest rates, and economic outlook also impact pricing.

As a property seller, being aware of these helps set expectations and position your home competitively.

A Property Seller’s Toolkit: Valuation Methods You Can Use

There are multiple ways to value a property, each with its own benefits.

1. Use a House Price Calculator Ireland

These online tools offer a starting point for any property seller, providing estimates based on market trends and historical sale data. While these tools vary in quality, some offer more comprehensive insights than others.

2. Hire a Chartered Valuer or Estate Agent

For a hands-on, in-depth assessment, professionals can evaluate every aspect of your home in context with the local market. This is especially useful if your property has unique features or is located in a niche market.

3. Compare Similar Properties (Comps)

This is a popular DIY method. By researching comparable homes in your area (often referred to as “comps”), you can get a feel for pricing. However, make sure you’re comparing properties with similar specifications and conditions.

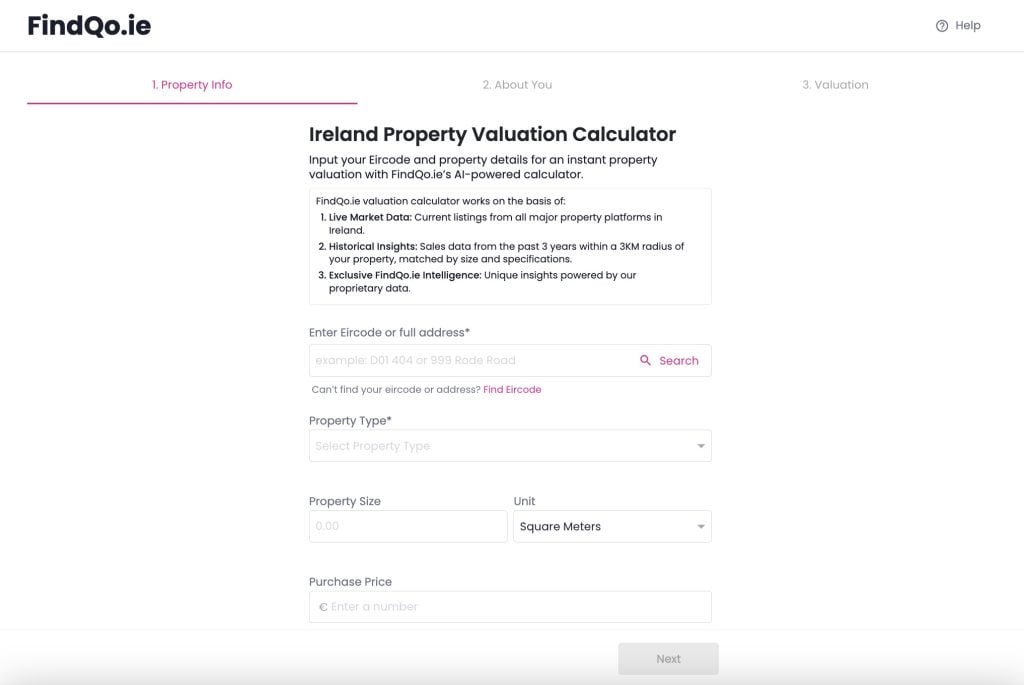

Introducing a Smarter Way to Value: FindQo.ie’s Property Valuation Tool

FindQo.ie offers a reliable, AI-driven valuation calculator designed specifically for the Irish market. It’s an ideal solution for any property seller looking to get a fast, credible estimate based on live and historical market data.

This tool sets itself apart by leveraging:

Live Market Data

Drawing from all major Irish rental and sales platforms, it reflects the actual conditions in your area, right now. No guesswork—just up-to-date insights.

Historical Insights

It reviews comparable rents and sales based on your property’s size, type, features, and location. This provides a fuller picture than tools relying only on current listings.

Exclusive FindQo.ie Intelligence

Powered by proprietary AI technology, it delivers unique predictions and pricing intelligence that standard calculators simply cannot match.

How to Use the FindQo.ie Valuation Tool (Step-by-Step)

- Visit FindQo.ie Property Valuation Page

- Enter Your Property Details – Type, size, bedrooms, bathrooms, location, and any standout features.

- Get Your Instant Estimate – Within seconds, receive a valuation backed by real-time data.

- Refine & Compare – Use the estimate to plan your pricing or cross-check with other methods.

It’s particularly useful if you’re comparing multiple properties or deciding whether to sell or rent.

Tips for Property Sellers Before You List

Even after using a valuation tool, here are a few things you should do:

- Get Your Paperwork Ready: Title deeds, BER certificate, and planning permissions will be needed during the selling process.

- Stage Your Property: Presentation matters. A well-staged home may increase perceived value and reduce time on the market.

- Stay Flexible: If the market changes, revisit your valuation before setting your asking price.

- Talk to Local Estate Agents: Use your valuation estimate as a benchmark, then get a few opinions from professionals in your area.

Should You Get Multiple Valuations?

Yes—especially if you’re dealing with a high-value or unusual property. Combine online tools, agent appraisals, and local market data for a well-rounded view.

FindQo.ie’s calculator gives a solid foundation, but no tool should be your only source. Think of it as the first step in a smarter property selling strategy.

Final Thoughts: A Reliable Property Platform for Modern Sellers

Valuing your property properly sets the stage for everything that follows—marketing, negotiation, and ultimately closing the deal. As a property seller, using a reliable property platform like FindQo.ie helps you navigate this journey with confidence.

You’re not just listing a home—you’re making one of the biggest financial moves of your life. Make sure your valuation process is as informed and intelligent as the decision itself.

Try the free valuation tool today and discover what your property is really worth: Ireland Property Valuation Calculator.