Buying a home is one of the most significant financial decisions anyone can make, and in Ireland, that process can come with a few unique challenges. Whether you’re a first-time buyer or returning to the market after years, navigating the property landscape without making costly errors is essential.

This guide explores the top mistakes when buying property in Ireland and how to avoid them. If you’re planning to make the leap in 2025 or beyond, these tips could save you time, money, and a lot of unnecessary stress.

1. Failing to Understand the Irish Property Market

One of the most common property buying pitfalls in Ireland is diving in without truly understanding the current market conditions. Ireland’s housing market is constantly evolving, with price differences not just between counties, but even neighbourhoods.

Tip: Take time to research average property prices, local trends, and future developments. A property in Dublin City will demand a very different budget and strategy than one in rural Offaly or the Midlands.

2. Not Getting Mortgage Approval in Principle First

Too often, buyers start viewing homes without first knowing how much they can borrow. This mistake can result in wasted time or disappointment if you fall in love with a property out of your budget.

Tip: Before you begin house hunting in Ireland, always apply for mortgage approval in principle. This gives you a realistic price range and boosts your credibility with estate agents and sellers.

3. Underestimating Additional Costs

Buying a house involves more than just the sale price. Many buyers forget to factor in stamp duty, legal fees, valuation costs, surveys, and possible renovation expenses.

Tip: Budget for at least 10% extra on top of your purchase price to cover these costs. Also, be aware that property taxes and utility setup fees can vary depending on the location in Ireland.

4. Skipping a Professional Survey

Skipping a building survey is one of the riskiest mistakes when buying property in Ireland. Even a newly-built home can have hidden issues that will cost you dearly later on.

Tip: Always hire a registered building surveyor before closing the deal. They’ll identify structural issues, damp, outdated wiring, or other red flags—giving you peace of mind or a chance to renegotiate.

5. Ignoring BER Ratings

The Building Energy Rating (BER) tells you how energy efficient a property is. In Ireland, this rating can significantly impact long-term costs for heating and electricity.

Tip: Always check a property’s BER rating. A lower-rated home might look like a bargain but could cost thousands in energy bills or upgrades.

6. Getting Caught Up in Bidding Wars

In competitive areas, it’s easy to get swept up in emotional bidding and offer more than the property is worth.

Tip: Set a maximum price limit and stick to it. Use recent comparable sales in the area as your benchmark. Overspending is one of the most regrettable property buying pitfalls in Ireland.

7. Not Considering Future Resale Value

You may be buying your “forever home”, but circumstances change. Many buyers forget to consider the property’s potential resale value, which can become a problem if you need to move.

Tip: Evaluate location, nearby schools, transport links, and development plans. These all affect future property value and desirability.

8. Overlooking Legal and Title Issues

Ireland has its own legal process for property transactions. Issues with title deeds, boundaries, or planning permission can delay—or derail—your purchase.

Tip: Always work with a reputable solicitor familiar with property transactions in Ireland. They’ll ensure that all documentation is in order, so you’re not left with surprises down the line.

9. Forgetting to Valuate Your Existing Property

If you’re trading up or selling your current home to fund a new one, not knowing your existing property’s value can disrupt your budget and timeline.

Tip: Use FindQo.ie to valuate your property for free before you start. This gives you a clearer idea of how much you can afford and where you stand in the market.

10. Not Exploring Online Property Platforms

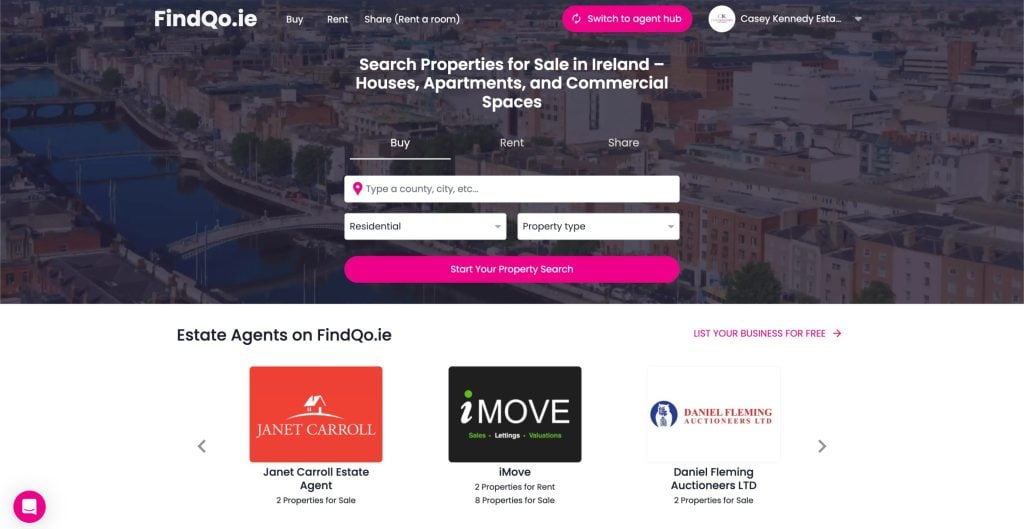

With so many new tools available, relying solely on traditional estate agents could limit your options. Buyers miss out by not exploring platforms with up-to-date listings and additional features.

Tip: On FindQo.ie, you can browse hundreds of homes for sale across Ireland, compare locations, and even post ads if you’re selling or letting. If you’re a landlord, you also get 2 free ad listings at any time.

Bonus Tip: Don’t Skip Pre-Purchase Planning

Buying property in Ireland isn’t just about money—it’s also about lifestyle. Are you looking for a family-friendly suburb, a commuter town, or a quiet rural retreat?

Tip: Think long term. Consider your commute, amenities, schools, broadband coverage, and access to public transport before choosing an area.

Final Thoughts on Buying a Home in Ireland

Whether you’re a seasoned investor or a first-time buyer, buying a house in Ireland can be a rewarding experience—when done right. Avoiding common mistakes ensures you secure the right home, at the right price, in the right place.

Remember:

- Get financial clarity first

- Know your area

- Check everything twice

- Use online tools to your advantage

Looking to get started? Head over to FindQo.ie to:

- Valuate your home for free

- Post an ad with two free landlord listings

- Browse the latest property listings across Ireland

Make your next move a smart one because buying property should feel like a win, not a worry.