When it comes to Irish property, one of the most common dilemmas facing homeowners and investors is whether to rent out their property or sell it outright. Both options have their advantages, but which one brings more value in today’s market?

The answer depends on a number of factors your financial goals, the condition and location of the property, and of course, market demand. Fortunately, digital tools now make it easier than ever to assess the potential of your property. If you’re trying to make this decision, a rental estimate tool can give you the insights you need to evaluate whether renting is truly the more profitable route.

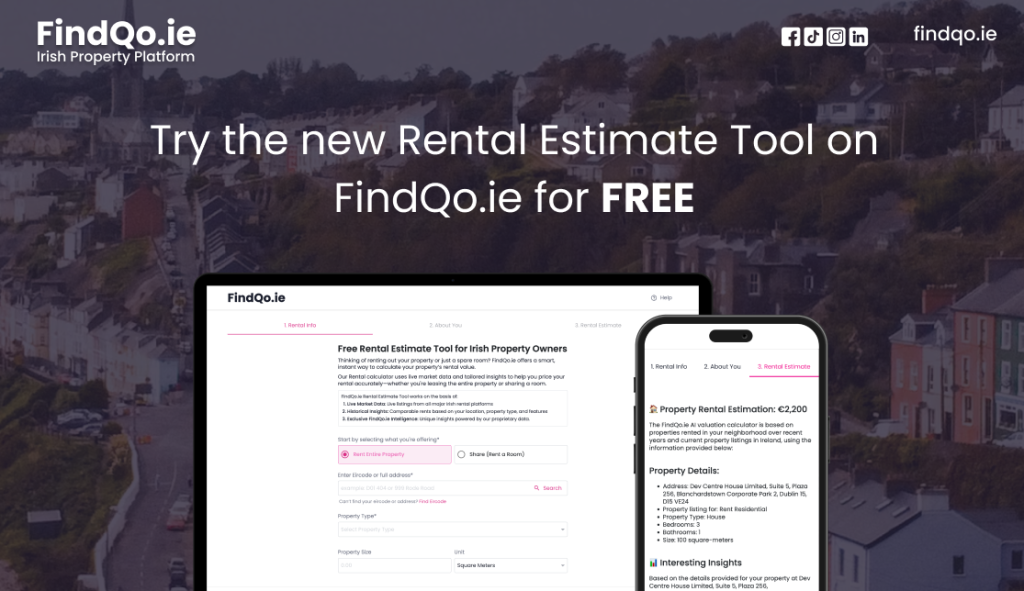

Let’s dive into the pros and cons of both options and see how FindQo.ie’s AI-powered rental estimate tool helps property owners make smarter decisions.

Selling vs Renting: What’s Right for You?

Whether you’re a homeowner relocating, an investor diversifying your portfolio, or someone who has inherited property, deciding whether to rent or sell is rarely straightforward.

Selling: A Quick Exit, But At What Cost?

Selling your home or investment property can free up a large sum of capital quickly. It’s often the go-to choice when:

- You need funds for another investment

- The market is favourable for sellers

- You don’t want the responsibility of being a landlord

However, the downside is finality you’re out of the property game for that asset, and future appreciation or rental income is off the table.

Renting: Long-Term Gain, Ongoing Commitment

Renting, on the other hand, opens the door to long-term passive income, which can outperform a one-time sale especially in rising markets like Ireland. That said, it comes with responsibilities: tenant management, maintenance, and tax considerations.

This is where a rental estimate tool becomes essential. It helps you understand if the projected rental yield is strong enough to justify the long-term commitment.

Why You Need a Rental Estimate Tool to Decide

Trying to guess your property’s rental potential based on a few listings or anecdotal feedback is unreliable. Market conditions shift frequently, and what a neighbour earns from their rental today might not reflect your property’s real value.

Enter the FindQo.ie Rental Estimate Tool a powerful, AI-driven platform built specifically for the Irish property market. It gives you a clear, data-backed answer to the key question: What is the rental income I could realistically expect from my home?

Access the tool here: https://findqo.ie/rental-estimate-tool

How the FindQo.ie Rental Estimate Tool Works

The FindQo.ie tool is not just a basic calculator. It’s a smart system that draws from multiple data sources to provide accurate, localised rent valuations. Here’s how it delivers its insight:

1. Live Market Data

The tool pulls in live rental listings from all major Irish platforms. This ensures you’re seeing the most current pricing for similar properties in your area down to street level.

Rather than relying on static averages, you get dynamic results based on today’s demand.

2. Historical Insights

Using comparative rent data, the tool analyses trends over time in your location. You can see how rents have moved over the past few years critical if you’re trying to project income over the long term.

It takes into account:

- Location

- Property type (e.g., flat, semi-detached, detached)

- Size and key features

- Local supply and demand cycles

3. Exclusive FindQo.ie Intelligence

This is where the tool really shines. FindQo.ie uses its own proprietary data models to surface nuanced, AI-driven insights. It factors in unique indicators such as:

- Demand patterns based on seasonality

- Rent pressure zone regulations

- Neighbourhood micro-trends

- The impact of amenities like home offices, broadband, and BER ratings

These smart analytics are what set this rental estimate tool apart in the Irish market.

Comparing Profitability: Renting vs Selling

Let’s consider a practical example.

Say you own a two-bedroom flat in Galway. You’re debating whether to sell now for €295,000 or rent it out at around €1,800 per month.

Scenario A: Selling

- Net proceeds (after fees, taxes): ~€280,000

- One-time gain, capital now available

Scenario B: Renting

- Annual rental income: ~€21,600

- Ongoing costs (maintenance, tax, agent fees): ~€4,000–€6,000

- Net income: ~€15,600 annually

- Capital appreciation potential remains

Within five years, you could earn €78,000+ in net rental income and retain a growing asset. If the property appreciates even modestly, renting could outperform selling over time but only if your rental price is set accurately.

This is why a rental estimate tool like FindQo.ie’s becomes invaluable. It allows you to forecast realistic returns and make side-by-side comparisons with confidence.

Other Factors to Consider Before You Decide

Choosing between renting and selling is not purely about numbers. Here are a few additional considerations:

1. Taxation

Selling might trigger Capital Gains Tax (CGT), whereas rental income is subject to Income Tax. However, you may be eligible for deductions on expenses as a landlord.

2. Rent Pressure Zones

If your property is located in an RPZ, rent increases are regulated. The FindQo.ie rental estimate tool flags these zones and helps you understand what’s legally permissible.

3. Mortgage and Financing

In some cases, rental income can help cover mortgage repayments while still providing extra cash flow. It’s worth checking your current mortgage terms to understand the flexibility.

4. Long-Term Property Goals

Do you want a steady income stream in retirement? Or would you rather reinvest the cash elsewhere? Your decision may depend on your broader financial strategy.

The Role of AI in Modern Property Decisions

One of the most powerful aspects of the FindQo.ie platform is how it uses artificial intelligence to spot patterns that a human might miss.

For example:

- Are properties with a home office renting faster post-pandemic?

- Do BER A-rated homes command a rent premium in your town?

- What’s the peak season for rental demand in Cork versus Limerick?

The FindQo.ie rental estimate tool learns from thousands of properties, helping to surface these insights automatically. It takes the guesswork out of pricing and lets data do the talking.

Use a Rental Estimate Tool to Make Smarter Property Decisions

So, is renting more profitable than selling in Ireland? The answer depends on your personal goals but using a rental estimate tool is the best way to inform your decision with real numbers, not assumptions.

With FindQo.ie’s Rental Estimate Tool, you’ll gain:

- A clear, accurate rental valuation

- Market insights specific to your location

- Proprietary AI-powered intelligence

- A stronger sense of whether renting is the better financial choice

Whether you choose to sell or rent, having the right data at your fingertips makes all the difference. Try the tool today and unlock the full potential of your property.