Setting the right rental price isn’t just about the property itself it also depends heavily on the length of the lease. Whether you’re a landlord looking to maximise returns or a tenant trying to budget smartly, understanding how lease duration influences rent can make a big difference.

In this guide, we’ll explore how to price rentals based on short-term, medium-term, and long-term leases, and how a rental estimate tool like FindQo.ie’s can help you find the sweet spot.

Why Lease Length Matters in Rental Pricing

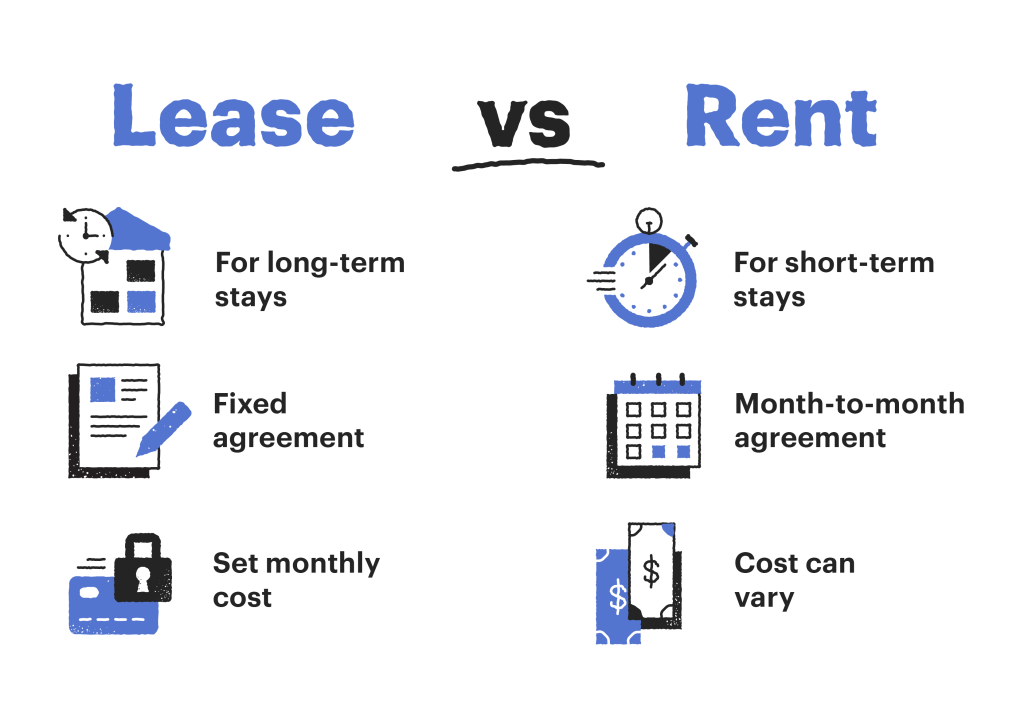

Lease length plays a crucial role in rental pricing because it reflects both risk and reward:

- Short-term leases (e.g. 1–6 months) offer flexibility but come with more frequent tenant turnover.

- Long-term leases (e.g. 12+ months) bring stability but may reduce pricing flexibility.

For landlords, adjusting pricing to suit the lease length ensures competitiveness while protecting profits. For tenants, understanding this structure helps negotiate better deals.

Pricing Short-Term Rentals (1–6 Months)

Short-term lets, such as monthly or weekly rentals, typically carry higher rental rates. This is due to:

- Increased turnover and vacancy risk

- Higher management and cleaning costs

- Demand from tourists, professionals, and expats

Typical pricing approach:

Short-term rents are often 25–50% higher per month than long-term leases, depending on location and demand.

💡 Use the FindQo.ie Rental Estimate Tool to benchmark what similar short-lets are charging in your area, based on live market data.

Pricing Medium-Term Rentals (6–12 Months)

Medium-term leases strike a balance between flexibility and consistency. They’re attractive to:

- Contractors on fixed-term projects

- International students

- People relocating but not ready to commit long-term

Pricing approach:

Rates may be slightly higher (around 10–15% more) than long-term leases but lower than short-term lets.

This pricing model also benefits from seasonal demand fluctuations. FindQo.ie’s tool offers historical insights to help determine the best rate based on the time of year and tenant profiles.

Pricing Long-Term Rentals (12 Months or More)

Long-term leases are the most common and offer landlords peace of mind with predictable income. Tenants are also often willing to sign longer agreements in exchange for lower monthly rent.

Pricing approach:

- Set rent based on average market rates for comparable properties in the area

- Offer minor discounts (e.g. 3–5%) for tenants willing to sign multi-year leases

This is where a rental estimate tool becomes critical. With FindQo.ie, landlords can:

- View average rents for similar long-term lets

- Factor in location, features, and furnishing status

- Adjust pricing based on demand and property condition

Should Rent Be Pro-Rated for Lease Length?

Yes, especially for non-standard durations (e.g. 8 months). It’s important to:

- Pro-rate rent fairly if the lease doesn’t start or end on the 1st of the month

- Adjust for seasonality rents in summer may command more, while winter may require a discount

Pro tip: The FindQo.ie tool reflects real-time listings from Irish rental platforms, helping landlords adjust for seasonality and tenant behaviour across different lease types.

Leveraging Data to Set the Right Price

Here’s how FindQo.ie’s Rental Estimate Tool helps you set rent confidently:

- 🔹 Live Market Data: Based on active listings across Ireland

- 🔹 Historical Insights: Compare with past lease trends for your area

- 🔹 Proprietary Intelligence: AI-enhanced analysis for accurate pricing, whether it’s a 3-month or 24-month lease

Balance Flexibility With Profitability

There’s no one-size-fits-all solution when it comes to lease pricing. But understanding how lease length impacts value allows you to build a pricing strategy that:

- Attracts the right kind of tenants

- Reflects real-world market trends

- Maximises your rental income over time

With AI-powered platforms like FindQo.ie, landlords in Ireland have access to smarter insights than ever before. Use the data. Trust the trends. And price with confidence.