Earning passive income is a financial goal for many homeowners in Ireland. Whether you’re relocating, downsizing, or simply exploring new income streams, renting out your home can be a smart and rewarding decision. However, before diving in, it’s crucial to know what your property is worth in today’s rental market and that’s where a rental estimate tool becomes invaluable.

If you’re wondering how much you could earn, how to price your property competitively, or if this income stream is truly passive, keep reading. We’ll break down what you need to know, from rental market insights to landlord responsibilities, and show you how FindQo.ie’s Rental Estimate Tool can guide your decisions with precision and confidence.

What Makes Rental Income Passive?

In theory, passive income is money you earn with minimal effort. Renting out a house fits that description to some extent but there are caveats. While the monthly rent payments may roll in regularly, being a landlord still requires some involvement, such as:

- Responding to tenant queries or issues

- Organising maintenance or repairs

- Ensuring compliance with Irish rental regulations

- Handling tenancy agreements and deposits

That said, if the property is in good condition, and you’ve vetted your tenants carefully, the level of effort can be relatively low. Many landlords also choose to use property management services, further reducing the time they need to spend.

How a Rental Estimate Tool Helps You Maximise Income

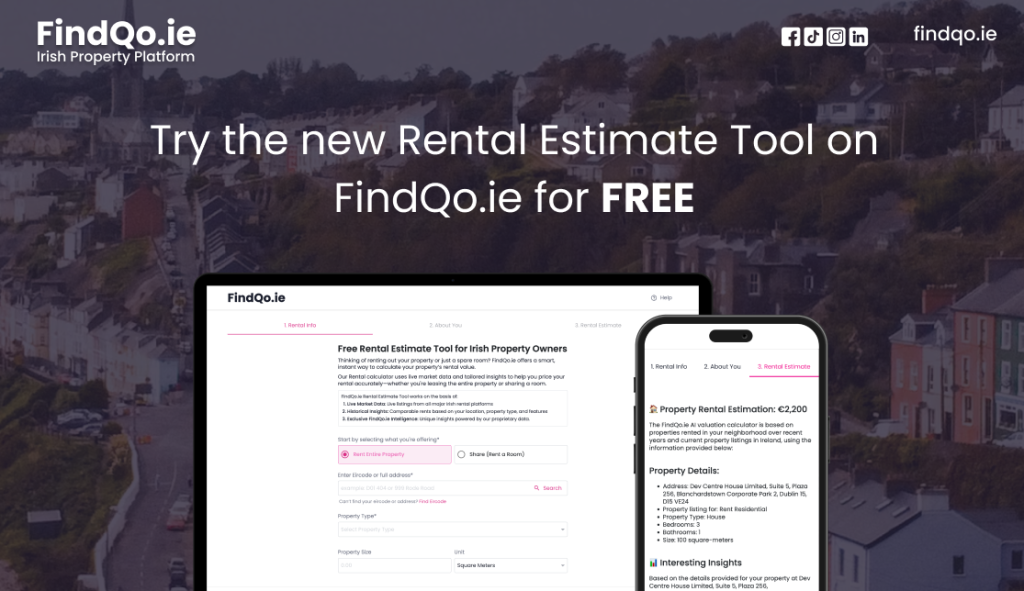

One of the most critical decisions you’ll make is how much rent to charge. Set it too low, and you miss out on earnings. Set it too high, and you risk longer vacancy periods. This is where the FindQo.ie Rental Estimate Tool proves its worth.

Why Use the FindQo.ie Rental Estimate Tool?

The FindQo.ie Rental Estimate Tool stands out for its accuracy, user-friendliness, and use of AI-driven insights tailored specifically to the Irish rental market. Here’s how it works:

Live Market Data

The tool pulls in real-time rental listings from all major platforms in Ireland, so you can see what similar properties are going for in your area right now.

Historical Insights

Get a clear view of comparable rents based on location, size, features, and property type. Understanding past trends helps you price with confidence not guesswork.

Exclusive FindQo.ie Intelligence

Using proprietary algorithms and models, FindQo.ie provides unique, data-backed rental insights that no other platform offers. It’s a smart, modern way to stay ahead in the rental market.

The best part? You can access the tool online in minutes and get a reliable estimate without any hassle.

Key Considerations Before Renting Out Your Home

Before listing your property, it’s important to evaluate whether it’s ready to generate passive rental income. Here are a few points to keep in mind:

1. Condition and Presentation

Tenants expect clean, safe, and functional homes. Upgrades like fresh paint, energy-efficient appliances, and modern bathrooms can improve both your rental value and tenant satisfaction.

2. Furnished or Unfurnished?

Furnished properties generally command higher rents but may require more maintenance. Unfurnished homes attract longer-term tenants and less wear and tear. Use the rental estimate tool to compare rent levels for both options in your area.

3. Legal Requirements

You must meet the minimum standards for rental accommodation set by the Residential Tenancies Board (RTB). This includes working smoke alarms, proper ventilation, secure windows and doors, and energy efficiency ratings.

4. Tax Implications

Rental income is subject to tax, though expenses like repairs, insurance, and management fees can be deducted. Speak to a tax advisor to ensure compliance and optimise your earnings.

How Much Can You Realistically Earn?

The amount of passive income you can earn from renting your house in Ireland depends on several variables:

- Location – Properties in Dublin, Cork, and Galway typically command higher rents.

- Property size – A three-bedroom semi-detached house will earn more than a one-bed apartment.

- Features – Garden, parking, home office space, or high-speed broadband can increase appeal.

- Furnishings and finish – Well-furnished and modern properties often receive premium offers.

Here are some example estimates using the FindQo.ie Rental Estimate Tool:

- Dublin (2-bed apartment): €2,000 – €2,300/month

- Cork (3-bed semi-detached): €1,800 – €2,100/month

- Galway (1-bed flat): €1,400 – €1,600/month

- Limerick (3-bed house): €1,600 – €1,900/month

These figures are indicative. For a precise estimate tailored to your property, use the FindQo.ie Rental Estimate Tool today.

Turning Rental Income Into a Truly Passive Strategy

To reduce the hands-on work involved with renting, consider the following:

Hire a Property Manager

Letting agents or property managers can handle tenant communication, maintenance, inspections, and even rent collection. While they charge a fee (usually 8–12% of monthly rent), many landlords find it worthwhile for peace of mind.

Screen Tenants Carefully

A reliable tenant can mean years of stress-free rental income. Always run reference checks, employment verification, and review previous rental history.

Invest in Long-Term Maintenance

Keeping the property in top condition prevents costly repairs and tenant dissatisfaction down the line. Set aside a portion of your rental income for ongoing maintenance.

Re-Evaluate Rent Annually

Markets change. Use the rental estimate tool once a year to ensure your pricing remains competitive and reflects current demand.

Why Passive Income from Renting Makes Sense in Ireland

With property prices stabilising and rental demand remaining high, Ireland continues to offer favourable conditions for landlords. Factors contributing to this include:

- Limited housing supply in major cities

- Strong demand from students, professionals, and remote workers

- The flexibility of renting out part of your home (such as a converted attic or garden flat)

As interest in the rental market grows, homeowners are increasingly turning to tools like FindQo.ie to support informed, confident decision-making.

Start Earning Smarter with the Right Tools

Renting out your house in Ireland can absolutely be a source of passive income especially if you take a strategic approach. By preparing your home properly, staying on top of legal requirements, and pricing your rent with data, you can generate a steady and reliable income stream.

The FindQo.ie Rental Estimate Tool is your go-to solution for setting the right rent. Powered by live listings, historical trends, and exclusive AI insights, it’s the smartest way to know exactly what your property is worth in today’s market.

So, if you’re ready to put your home to work, take the first step: Get your rental estimate today.