In today’s dynamic property market, understanding rental income is more important than ever especially if you’re planning to let out your property to help cover your mortgage. That’s where a rental estimate tool can become your best ally.

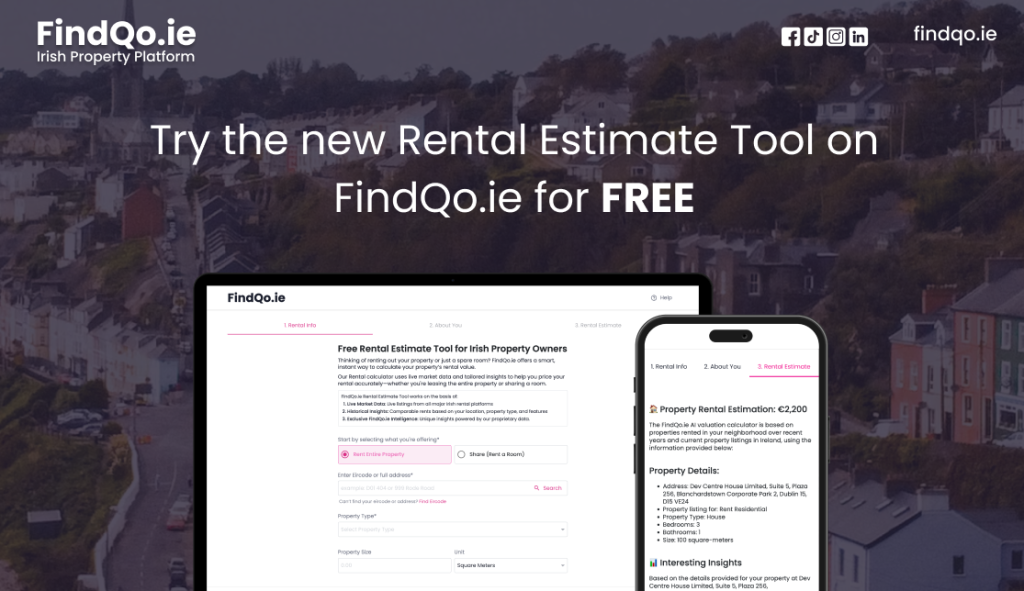

Whether you’re a first-time landlord or a seasoned investor, the question remains the same: How much rental income is enough to cover my mortgage? In this guide, we’ll break down that answer and show you how to make data-driven decisions using FindQo.ie’s Rental Estimate Tool https://findqo.ie/rental-estimate-tool free, no sign-up, no limits, powered by AI-driven insights from the Irish rental market.

Understanding Rental Income vs. Mortgage Payments

Let’s start with the basics. Your rental income is the monthly rent you receive from tenants, while your mortgage payment is the amount you owe your lender each month. Ideally, your rental income should not only cover your mortgage but also contribute to ongoing expenses like property maintenance, taxes, insurance, and the occasional vacancy.

So, what’s the magic number? As a rule of thumb, landlords aim for the 1% rule charging rent that is at least 1% of the property’s purchase price. However, in Ireland’s competitive housing market, especially in urban areas like Dublin, Cork or Galway, this figure can vary significantly.

This is where a rental estimate tool https://findqo.ie/rental-estimate-tool free, no sign-up, no limits becomes essential.

Why You Need a Rental Estimate Tool

With market conditions constantly shifting, relying on guesswork or outdated figures simply won’t do. A rental estimate tool helps you determine the going rental rate for your property, ensuring you neither undercharge nor overprice both of which could cost you dearly.

Accurate, Real-Time Data

The FindQo.ie Rental Estimate Tool uses live market data sourced from all major Irish rental platforms. This ensures that you’re working with the most current rental figures available.

Backed by Historical Insights

Beyond the present, FindQo.ie’s tool taps into historical data, offering comparisons based on your property’s location, type, and features. This gives you a long-term view and helps you identify trends.

Powered by Exclusive Intelligence

What sets FindQo.ie apart is its exclusive intelligence, derived from proprietary data unique to the platform. This AI-driven approach brings unmatched accuracy to the estimate you receive.

You can try the tool for free, with no sign-up required and no usage limits

Calculating Break-Even Rental Income

Now that you know what your potential rent might be, it’s time to work out if that income will cover your mortgage.

Here’s a simple step-by-step breakdown:

- Identify your monthly mortgage payment – This includes principal, interest, and any insurance or tax escrow.

- Estimate your monthly rental income – Use the FindQo.ie Rental Estimate Tool for this.

- Account for additional costs, such as:

- Letting agent fees (typically 8–12%)

- Maintenance and repairs

- Property insurance

- Periods of vacancy

- Letting agent fees (typically 8–12%)

Let’s consider a quick example:

- Monthly mortgage payment: €1,200

- Estimated monthly rent: €1,500

- Total monthly expenses (incl. 10% agent fee, €100 for maintenance): €250

Net profit: €1,500 – €1,200 – €250 = €50

While the profit seems modest, it shows that the rent not only covers your mortgage but also the related expenses, and you’re cash-flow positive.

When Rental Income Falls Short

Not every property will meet the 1% rule or break even right away. Sometimes, rental income might cover only a portion of your mortgage. That doesn’t always mean it’s a bad investment.

Consider Long-Term Gains

Many property investors look at capital appreciation over time. Even if your rental income falls short in the early years, your property may increase in value significantly.

Adjust Strategy

Use the rental estimate tool to research nearby properties with better income potential. You might find that making small improvements like adding energy-efficient upgrades or allowing pets can increase your rental value.

Benefits of Using FindQo.ie’s Rental Estimate Tool

Using FindQo.ie’s Rental Estimate Tool brings several benefits to the table:

- Speed: Get instant rental estimates without any sign-up.

- Simplicity: Just enter your property details no spreadsheets, no jargon.

- Accuracy: Thanks to live listings, historical insights, and proprietary data, you get a crystal-clear view of rental potential in your area.

It’s especially helpful for landlords, investors, or even homeowners simply curious about what their property could fetch on the market.

Make Smarter Rental Decisions

To truly know if your rental income will cover your mortgage, you need to look beyond rough estimates. With tools like FindQo.ie’s Rental Estimate Tool, you’re equipped with real, reliable data to back every decision.

Don’t leave it to chance run your property through the tool today at https://findqo.ie/rental-estimate-tool and gain the confidence that comes from knowing your numbers.

Remember: The right rental estimate can mean the difference between covering your mortgage or falling behind. With the Irish market as dynamic as ever, let data lead the way.