When renting a property, it’s important to understand the various costs that should be covered by your rental agreement, particularly when it comes to insurance. As a tenant, you may assume that your rent should cover all your needs, but what about insurance costs? How can you ensure you are not left exposed financially? In this blog post, we will explore the key insurance costs that should be considered when renting, how to protect yourself, and why a rental estimate tool https://findqo.ie/rental-estimate-tool free, no sign-up, no limits, can help you budget effectively for your new rental home.

What Is Rent Insurance and Why Does It Matter?

Rent insurance, often referred to as tenant insurance, is a type of coverage designed to protect both the tenant and the landlord in case of unforeseen events. For tenants, this typically includes protection for personal property, liability in case of accidents, and other essential coverage.

The rental market is often unpredictable, and having a solid insurance plan can save tenants from significant financial strain. In Ireland, with property prices on the rise and demand for rental properties remaining high, understanding the insurance costs that should be included in your rent is crucial for financial planning.

The Key Insurance Costs You Should Consider

Insurance can seem complex, but breaking it down into key areas makes it easier to navigate. Let’s look at the main types of insurance that rent might cover, and where you might need to take additional steps to protect yourself.

1. Tenant’s Insurance (Contents Insurance)

Tenant’s insurance, or contents insurance, is perhaps the most common type of insurance for renters. It covers personal belongings inside the rental property in case of theft, fire, or water damage. While some landlords may include this as part of your rental agreement, many will not.

Should Rent Cover This? It’s highly unlikely that your rent will cover your personal contents insurance, so tenants are generally required to take out their own insurance for their possessions. However, it’s important to confirm with your landlord whether this is included or whether it will be your responsibility.

You can access and use the tool https://findqo.ie/rental-estimate-tool free, no sign-up, no limits.

2. Liability Insurance

Liability insurance covers you if you cause damage to the property or harm to others while living in the rental. For example, if a guest is injured in your rented home or if you accidentally cause damage to the landlord’s property, this coverage can protect you from legal and financial consequences.

Should Rent Cover This? In some cases, landlords may include liability insurance in the rental agreement, but it’s not guaranteed. In Ireland, it’s typical for tenants to take out their own liability coverage, as this is primarily for their benefit.

3. Building Insurance (Landlord’s Responsibility)

Building insurance typically covers the structure of the property itself – the walls, roof, plumbing, and electrical systems. This is generally the landlord’s responsibility and is not something that tenants need to worry about.

Should Rent Cover This? No, rent does not typically cover building insurance, as this is the landlord’s responsibility. However, it’s crucial for tenants to clarify that their landlord has appropriate building insurance in place, as this protects both parties from costly repairs in the event of damage.

4. Accidental Damage Insurance

This type of insurance protects you from being held financially liable for accidental damage to the property. If you spill red wine on the carpet or accidentally damage the walls, accidental damage insurance can help cover the repair costs.

Should Rent Cover This? Accidental damage insurance is not commonly included in the rent, and tenants are usually required to secure their own coverage. However, some landlords may offer an option for tenants to take out accidental damage coverage as part of the lease agreement. It’s worth checking your rental terms to ensure you’re properly protected.

5. Renter’s Legal Expenses Insurance

In some cases, renters may want coverage for legal expenses related to disputes with their landlord or other tenants. For example, if you need legal representation regarding a security deposit dispute, this type of insurance can help cover the costs.

Should Rent Cover This? This type of coverage is not typically included in rent, but it can be a wise investment for tenants who want additional peace of mind in case of legal disputes. It is advisable to secure your own legal expenses insurance if you feel it’s necessary.

How to Use a Rental Estimate Tool for Financial Planning

Now that you have a better understanding of the insurance costs that should be covered by rent, it’s time to consider how to effectively plan your budget. A rental estimate tool can be incredibly helpful in estimating what your rent might be, and whether your insurance costs can be incorporated into your rental budget.

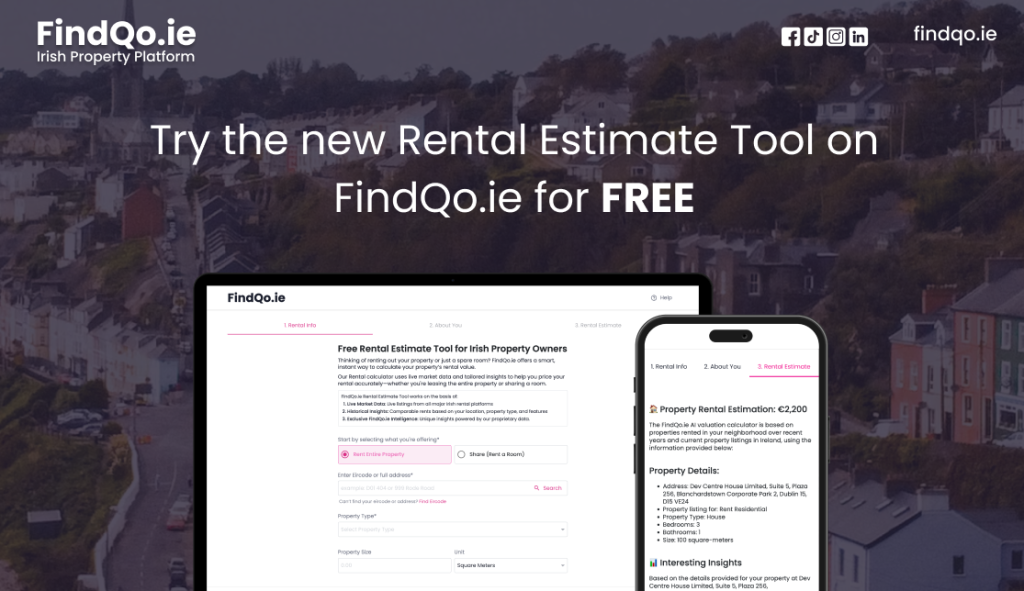

For example, FindQo.ie’s Rental Estimate Tool is an excellent resource for renters in Ireland. This tool works on the basis of:

- Live Market Data: Access to live listings from all major Irish rental platforms.

- Historical Insights: Comparable rents based on location, property type, and features.

- Exclusive FindQo.ie Intelligence: Unique insights powered by proprietary data.

By using this tool, renters can get a better sense of how much they might expect to pay for a rental property and plan their budget accordingly. It’s free to use, with no sign-up required, and gives access to valuable insights powered by AI-driven intelligence.

How to Protect Yourself and Avoid Hidden Costs

One of the biggest challenges tenants face is navigating hidden costs in rental agreements. To ensure you’re not caught off guard, it’s important to:

1. Carefully Read the Lease Agreement

Before signing any rental agreement, ensure that you thoroughly understand what is included in your rent. Don’t assume that insurance or other costs will automatically be covered. If the lease mentions that certain insurances are provided, ask for clarification on the type and extent of the coverage.

2. Understand Your Rights as a Tenant

In Ireland, tenants have rights when it comes to renting property. Familiarising yourself with the Residential Tenancies Act (RTA) can help ensure that you’re not held responsible for insurance costs that are the landlord’s responsibility. Seek legal advice if you’re uncertain about any clauses in your agreement.

3. Budget for Additional Insurance Costs

As mentioned, many types of insurance (like tenant contents or liability insurance) are usually the tenant’s responsibility. Make sure to factor these costs into your rental budget. With tools like the FindQo.ie Rental Estimate Tool, you can get a better idea of your overall rental costs and plan ahead.

4. Use a Rental Estimate Tool to Forecast Future Costs

If you’re unsure about future rental trends or possible changes to rental prices in your area, using a rental estimate tool can provide valuable insights. With up-to-date market data and historical trends, you can get a better understanding of rental rates in your desired location.

When renting a property, understanding the insurance costs that your rent should cover is essential to avoid any unexpected financial burdens. By knowing what types of insurance are your responsibility and which are the landlord’s, you can plan your budget more effectively. Additionally, tools like the FindQo.ie Rental Estimate Tool can help you estimate your rental costs accurately, so you can stay financially prepared.

Whether you’re a first-time renter or a seasoned tenant, it’s important to ensure that your rental agreement covers the necessary insurance, while also being aware of the additional protections you may need to secure yourself. By staying informed and using the right tools, you can protect yourself from potential pitfalls in the rental process.

Don’t forget to visit https://findqo.ie/rental-estimate-tool free, no sign-up, no limits, to start planning your next rental today!