Knowing the value of your property is essential, whether you are selling, refinancing, or simply assessing your investment. In Ireland, property valuations can vary based on several factors, including location, property size, and the type of valuation you require.

If you are wondering how much it costs to get your house valued in Ireland, this guide will break down the costs, explain the different types of valuations, and help you find the best property valuation experts.

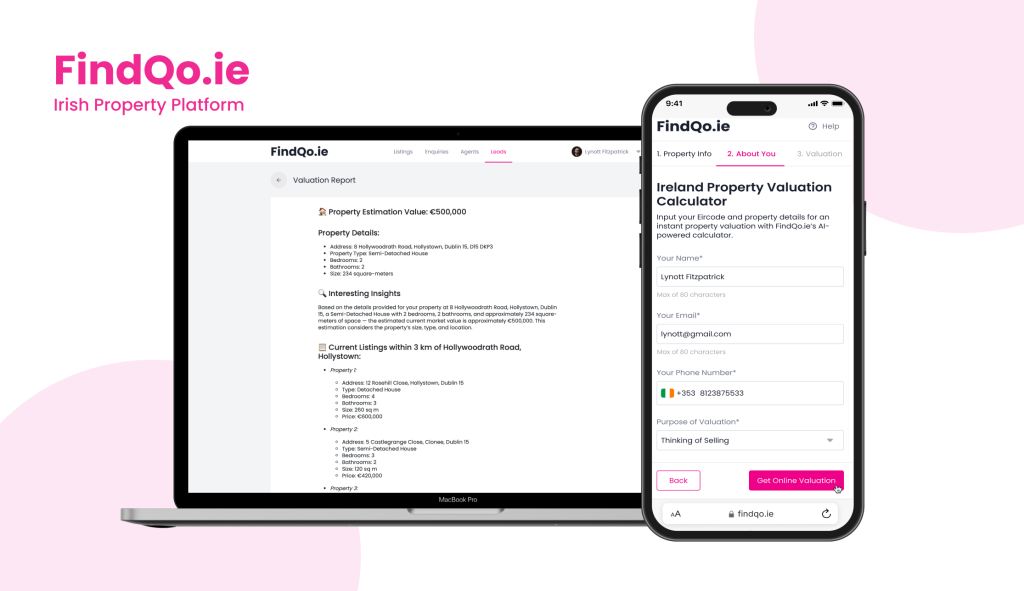

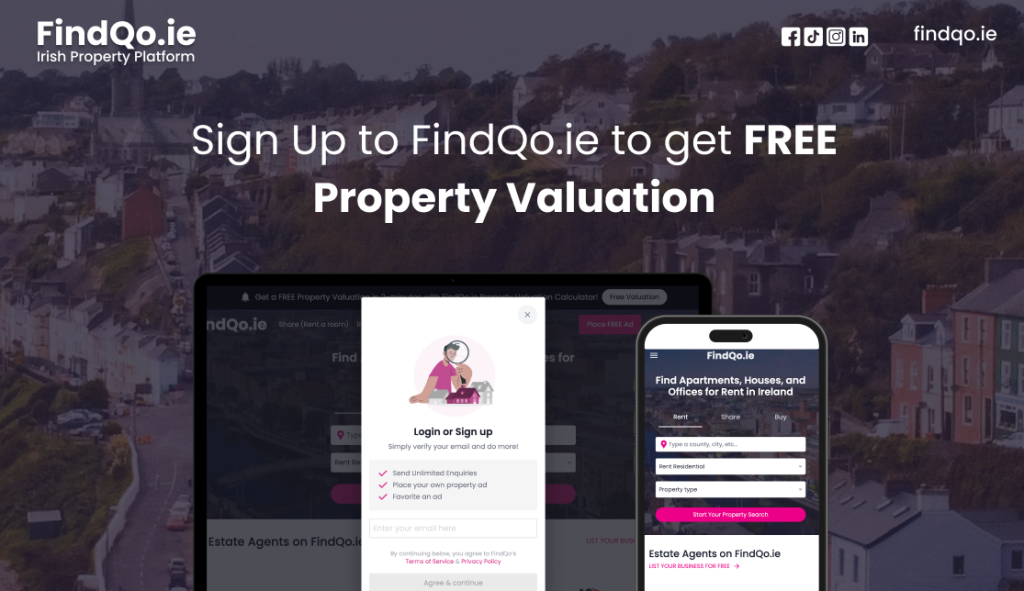

For those looking for a quick and free property valuation, you can use FindQo.ie to evaluate your house at no cost: Get Your Free Property Valuation Here.

Why Get Your House Valued?

A property valuation is more than just knowing your home’s worth; it is an essential step in many financial and legal processes. Here are some key reasons why homeowners in Ireland seek property valuations:

1. Selling Your Home

If you are selling, a valuation helps you set a competitive asking price. An accurate price ensures you attract buyers without undervaluing or overpricing your property.

2. Mortgage Approval & Refinancing

Banks and financial institutions require property valuations to approve mortgages or refinance loans. Lenders want to ensure the home’s value aligns with the loan amount.

3. Property Tax & Legal Purposes

A valuation may be required for tax assessments, probate cases, or divorce settlements. An official valuation ensures legal accuracy.

4. Investment and Market Analysis

For property investors, valuations help assess market trends, rental potential, and investment growth.

Now that we understand the importance of valuations, let’s explore the costs involved.

How Much Does It Cost to Get Your House Valued in Ireland?

The cost of getting a house valued in Ireland depends on the type of valuation service you need. Here are the typical pricing structures:

1. Free Online Property Valuations

Many platforms, including FindQo.ie, offer free online property valuations. These are ideal for homeowners looking for a quick estimate of their house value.

Cost: Free

Best for: Homeowners who need a general estimate before deciding on further steps.

Get a free valuation here: FindQo.ie Free Property Valuation.

2. Estate Agent Valuations

Most estate agents in Ireland provide property valuations, either for free or for a small fee. These valuations are commonly used when homeowners plan to sell their property through the agent.

Cost: Free to €150

Best for: Homeowners preparing to sell and looking for market-based valuation insights.

3. Chartered Surveyor Valuations

For official valuations required for mortgages, legal cases, or tax purposes, a chartered surveyor is required. These valuations are more detailed and legally recognised.

Cost: €250 – €500+

Best for: Mortgage applications, probate, tax assessments, and legal disputes.

4. Bank or Lender Valuations

When applying for a mortgage or refinancing, banks often require a formal valuation by an independent valuer from their approved panel. The cost is usually paid by the borrower.

Cost: €150 – €300

Best for: Mortgage approvals and refinancing purposes.

5. Independent Valuation Experts

Some property owners opt for independent valuation experts who provide comprehensive reports on market trends, property conditions, and comparative sales analysis.

Cost: €300 – €800

Best for: Investors, legal disputes, and detailed property assessments.

Factors That Influence Property Valuation Costs in Ireland

While the pricing structures above provide a general estimate, the actual cost of a valuation depends on several factors:

1. Property Location

Houses in Dublin, Cork, and Galway typically have higher valuation fees due to stronger market demand and higher property values.

2. Property Size & Type

Larger homes, commercial properties, or period houses often require more detailed assessments, increasing the cost.

3. Type of Valuation Required

- Bank valuations are standardised and have fixed fees.

- Legal valuations may require more detailed reports, increasing costs.

- Investment valuations require market research, which adds to the expense.

4. Experience & Reputation of the Valuer

Highly experienced chartered surveyors or property valuation experts may charge higher fees for their expertise.

How to Choose the Right Property Valuation Service in Ireland

With multiple options available, how do you choose the best valuation service?

1. Determine Your Needs

- Selling? Use an estate agent valuation or a free online tool.

- Applying for a mortgage? A bank-approved valuer is required.

- Legal or tax purposes? Hire a chartered surveyor.

2. Compare Pricing & Reviews

Research local valuation experts and compare their fees, customer reviews, and expertise.

3. Check Certifications

Ensure your valuer is registered with the Society of Chartered Surveyors Ireland (SCSI) or approved by banks.

4. Use Free Online Valuation Tools First

Before paying for a valuation, get a quick estimate online to understand your property’s market value.

For a fast, free estimate, check out: FindQo.ie Free Property Valuation.

Key Takeaways: How Much Does It Cost to Get a House Valued in Ireland?

- Free property valuations are available online, such as on FindQo.ie.

- Estate agent valuations are often free or cost up to €150.

- Chartered surveyor valuations range from €250 – €500+, depending on complexity.

- Bank valuations for mortgage purposes typically cost €150 – €300.

- Independent valuation experts charge €300 – €800, depending on the service.

The right choice depends on why you need the valuation. If you need an accurate property estimate, start with a free online valuation before deciding on a formal appraisal.

Get a Free Property Valuation in Ireland Today

If you are looking to value your home in Ireland, FindQo.ie offers a fast and free online property valuation tool to give you an estimate within minutes.

Check the market value of your home today:

Understanding your property’s value is the first step in making informed real estate decisions. Whether you are selling, refinancing, or planning for the future, a valuation ensures you stay ahead in Ireland’s property market.