Dublin’s thriving property market has long attracted investors seeking lucrative returns. One of the most critical factors to consider when evaluating investment opportunities is rental yield a metric that helps assess the profitability of a rental property. But what exactly are the rental yields in Dublin for residential projects, and how can investors navigate this dynamic market?

In this comprehensive guide, we explore rental yields in Dublin, the factors affecting these yields, and how platforms like FindQo.ie can help you find the best investment opportunities.

Understanding Rental Yields

Rental yield is the annual rental income generated by a property, expressed as a percentage of its purchase price or current market value. This key metric helps investors gauge the profitability of a property.

There are two primary types of rental yields:

- Gross Rental Yield: Calculated before deducting expenses, it is determined by dividing the annual rental income by the property’s purchase price and multiplying by 100.

- Net Rental Yield: This accounts for expenses such as maintenance, property taxes, and insurance. It provides a more accurate picture of the actual return on investment.

For example, if a property in Dublin generates €20,000 in annual rental income and was purchased for €400,000, the gross rental yield would be 5%.

Dublin Property Market Overview

Dublin remains one of the most attractive property investment destinations in Ireland, thanks to its robust economy, vibrant job market, and high demand for rental properties. Key trends shaping the current market include:

- Strong Rental Demand: Dublin’s growing population and status as a tech and financial hub have led to high demand for rental properties.

- Rising Property Prices: Property values in Dublin have steadily increased, making it a competitive market for investors.

- Government Regulations: Recent policy changes aimed at stabilising the rental market have impacted rental yields, highlighting the importance of strategic investment decisions.

Factors Affecting Rental Yields in Dublin

Several factors influence rental yields in Dublin, making it essential for investors to consider these elements before purchasing a property.

1. Location

Properties in prime areas such as Dublin 2, Dublin 4, and the Docklands tend to command higher rental prices but come with a premium purchase cost. Conversely, emerging neighbourhoods may offer better rental yields due to lower property prices and rising demand.

2. Property Type

- Apartments: Typically yield higher rental returns due to their popularity among young professionals and expatriates.

- Houses: While often more expensive, houses can attract families willing to pay a premium for space and amenities.

3. Market Demand

Dublin’s rental market is heavily influenced by employment trends, population growth, and student demand. Areas near business hubs and universities tend to have higher rental yields.

4. Property Condition

Well-maintained and modern properties can command higher rents, improving rental yields. Investing in renovations and energy efficiency upgrades can significantly boost returns.

5. Government Policies

Regulations such as rent caps and tenancy laws can impact rental yields. Staying informed about policy changes is essential for investors.

Average Rental Yields in Dublin

While rental yields can vary based on location, property type, and market conditions, the following averages provide a general benchmark:

- City Centre Apartments: Gross rental yields of 4% to 6%.

- Suburban Houses: Gross rental yields of 3.5% to 5%.

- Emerging Neighbourhoods: Potential for yields of 5% or higher due to lower property prices.

It’s important to note that net rental yields may be lower once expenses are factored in. Investors should conduct a thorough financial analysis to determine the true profitability of a property.

Tips for Maximising Rental Yields in Dublin

To achieve higher rental yields, investors should consider the following strategies:

1. Choose the Right Location

Focus on areas with strong demand and growth potential. Emerging neighbourhoods can offer better returns compared to established prime locations.

2. Opt for Modern, Energy-Efficient Properties

Properties with modern amenities and energy-efficient features attract higher rents and reduce maintenance costs, boosting net rental yields.

3. Maintain the Property

Regular maintenance ensures the property remains attractive to tenants and retains its rental value.

4. Leverage Professional Property Management

Engaging a property management company can help streamline operations, reduce vacancies, and ensure compliance with regulations.

5. Stay Updated on Market Trends

Monitor rental market trends and policy changes to make informed investment decisions. Platforms like FindQo.ie provide valuable insights and property listings to help investors stay ahead.

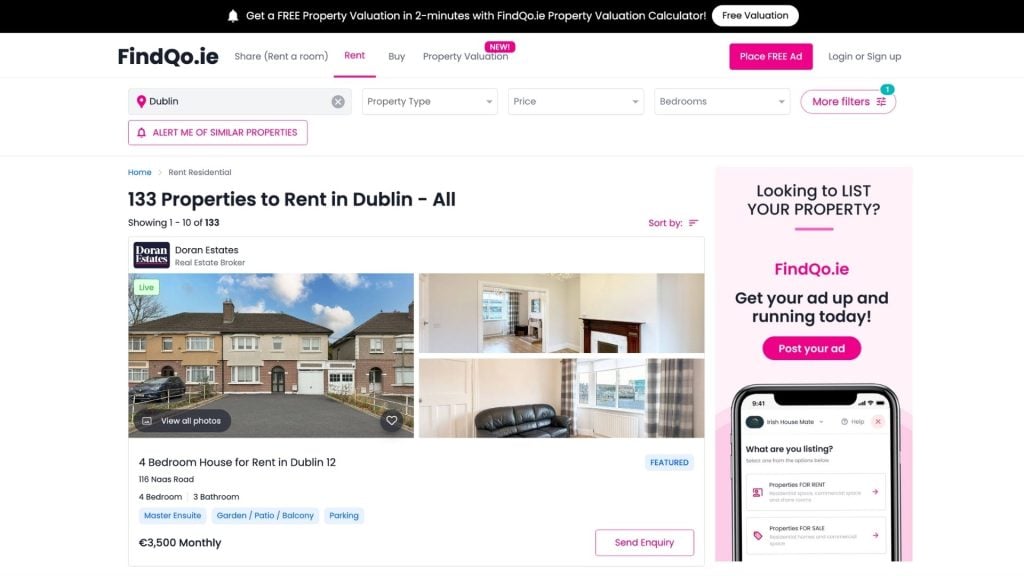

Why Use FindQo.ie for Dublin Property Investments?

FindQo.ie is a trusted platform for property seekers and investors in Dublin. Here’s why it’s the go-to resource:

- Comprehensive Listings: Browse a wide range of residential properties for rent in Dublin.

- User-Friendly Interface: Easily filter properties based on location, price, and other criteria.

- Expert Insights: Access valuable market information and investment tips.

- Trusted Network: Connect with reputable estate agents and property professionals.

By leveraging FindQo.ie, investors can make smarter decisions and find properties that offer competitive rental yields in Dublin.

The Dublin property market presents numerous opportunities for investors seeking strong rental yields. By understanding the factors influencing rental returns, choosing the right properties, and staying informed through platforms like FindQo.ie, you can maximise your investment potential.

Whether you’re a seasoned investor or new to the market, Dublin’s rental landscape offers promising prospects. Start exploring today and unlock the full potential of your property investments.