Common property valuation mistakes are one of the biggest reasons homeowners lose money when selling or make poor decisions when planning their next move. In a market where prices vary street by street, relying on assumptions rather than data can quickly lead to costly outcomes.

Many valuation errors are easy to avoid once you understand how modern property valuation works in Ireland. This guide highlights the most common mistakes homeowners make and explains how to get a clearer picture of true market value.

Common Property Valuation Mistakes Caused by Overpricing

One of the most frequent valuation mistakes is setting a price based on hope rather than evidence. Homeowners often look at the highest asking prices in their area and assume their property should match or exceed them.

However, asking prices are not the same as achieved prices. Overpricing can reduce buyer interest, extend time on the market, and eventually force price reductions. These delays often result in a lower final sale price than if the home had been priced correctly from the start.

Common Property Valuation Mistakes from Ignoring Local Data

Another major mistake is relying on broad market trends instead of local data. Property values can change significantly between nearby streets, especially in towns and cities.

Valuations that ignore Eircode level detail often miss what buyers are actually paying nearby. Without local sales comparisons, homeowners risk basing decisions on averages that do not reflect real demand in their immediate area.

Common Property Valuation Mistakes Linked to Outdated Information

Property markets move quickly. Using valuations from months or years ago is a common error that can lead to inaccurate expectations.

Recent confirmed sales and live listings provide the clearest indication of current value. Without this up to date data, homeowners may misjudge demand, price their home incorrectly, or delay decisions based on outdated assumptions.

Common Property Valuation Mistakes When Emotion Takes Over

Emotional attachment can cloud judgement. Many homeowners unintentionally overvalue improvements or personal features that buyers may not prioritise.

While condition and upgrades matter, buyers ultimately compare homes against alternatives in the same area. Valuation should reflect market behaviour, not personal sentiment, to avoid unrealistic pricing.

How the FindQo.ie Property Valuation Calculator Helps Avoid These Mistakes

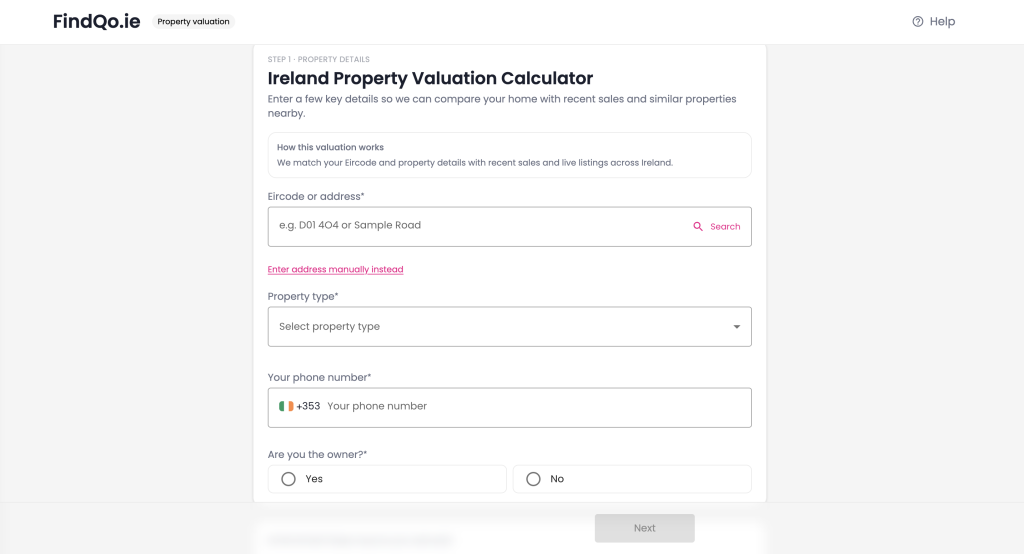

The FindQo.ie Property Valuation Calculator is designed to reduce these common valuation mistakes by using real data rather than guesswork. Powered by AI driven insights, the tool matches your Eircode and property details with recent sales and live listings across Ireland.

Instead of giving a single fixed number, FindQo.ie provides a realistic valuation range. This approach reflects how buyers behave in the market and allows homeowners to understand both current value and potential movement.

You can access the free valuation tool here:

How FindQo.ie Supports Smarter Property Decisions

FindQo.ie helps homeowners move from uncertainty to clarity. By combining valuation insights with live listings and local data, it supports better pricing decisions, stronger planning, and more confident conversations with agents or buyers.

Avoiding common property valuation mistakes starts with understanding the market properly. With the right tools, homeowners can protect value and make decisions based on evidence rather than assumption.

Final Thoughts

Common property valuation mistakes are costly but avoidable. Overpricing, outdated data, and emotional bias all reduce outcomes. Accurate valuation grounded in local sales and current listings is the foundation of better property decisions.

Using data led tools like FindQo.ie helps homeowners stay informed, realistic, and confident in an ever changing market.

Frequently Asked Questions

What are the most common property valuation mistakes homeowners make?

Overpricing, relying on outdated data, ignoring local sales, and letting emotion influence value.

Why is asking price different from property valuation?

Asking price reflects seller expectations, while valuation reflects what buyers are actually paying.

How does Eircode improve valuation accuracy?

Eircode analysis focuses on local market activity, capturing street level pricing differences.

Can free property valuation tools be trusted?

When based on recent sales and live listings, they provide reliable valuation ranges.

How does FindQo.ie help avoid valuation mistakes?

FindQo.ie uses AI driven insights, Eircode matching, and real market data to deliver realistic property valuations.