Property valuation is one of the most important steps when buying, selling, or simply understanding the true worth of a home in Ireland. Yet for many homeowners, the process can feel unclear or outdated. With the Irish property market constantly shifting, knowing how valuation works today can help you make smarter, more confident decisions.

This guide explains how modern property valuation in Ireland works, what factors influence house prices, and how AI driven tools are changing how homeowners understand value.

What Is Property Valuation and Why It Matters

At its core, property valuation is an informed estimate of what a property is worth in the current market. Unlike guesswork or asking prices, a proper valuation reflects real buyer behaviour, recent sales, and local demand.

In Ireland, property valuation plays a key role in selling a home, refinancing, inheritance planning, and general financial decision making. An accurate house valuation helps sellers avoid overpricing and allows buyers to assess whether a property is fairly valued.

How Property Valuation Works in Ireland Today

Modern property valuation in Ireland is data led. Instead of relying solely on opinion, valuations now combine local market data, recent sale prices, and comparable listings.

Key elements that influence valuation include location, property size, condition, layout, energy rating, and nearby amenities. Market conditions such as supply levels and buyer demand also play a major role in property pricing Ireland wide.

Because no two homes are identical, the most accurate valuations compare similar properties in the same area that have sold recently, rather than using national averages.

The Role of Eircodes and Local Market Data

One of the biggest advancements in property valuation is the use of Eircodes. By matching a specific Eircode, valuation tools can analyse recent sales and live listings within the same neighbourhood.

This localised approach provides a far clearer picture of real value. It accounts for street level differences, not just county or city wide trends, which is especially important in areas where prices can vary significantly within short distances.

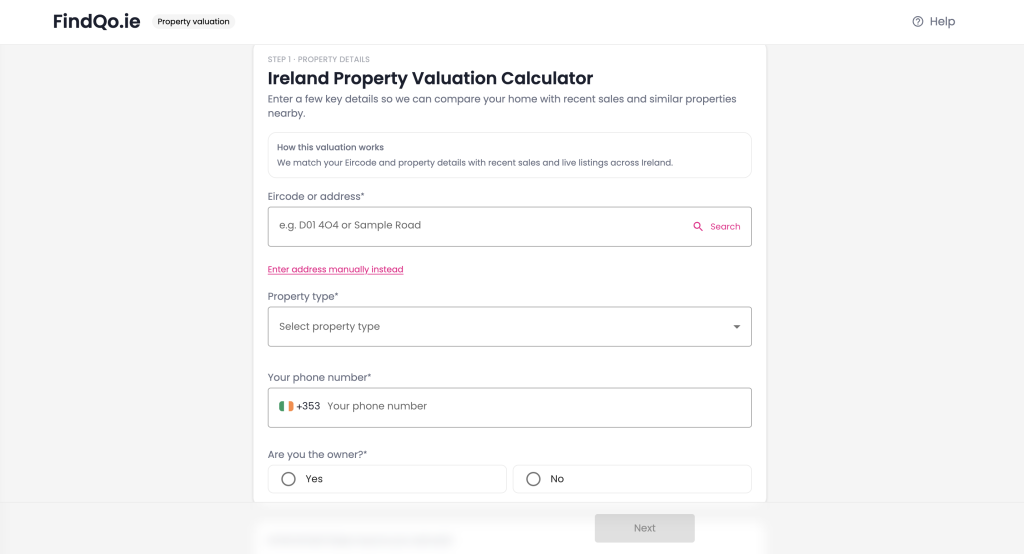

How the FindQo.ie Property Valuation Calculator Works

The FindQo.ie Property Valuation Calculator is built to reflect how property valuation works in Ireland today. It uses AI driven insights to analyse your Eircode and property details, then matches them against recent confirmed sales and live listings across Ireland.

By combining multiple data points, the tool delivers a realistic valuation range rather than a single fixed number. This helps homeowners understand where their property sits in the current market without relying on outdated estimates.

You can access the free valuation tool here:

Why Online Valuation Tools Are Becoming Essential

As the market becomes more competitive, online valuation tools give homeowners faster access to reliable insights. They are particularly useful for tracking value over time, preparing to sell, or checking how market changes affect your property.

While professional valuations still have their place, AI powered tools like FindQo.ie offer a strong starting point, grounded in real data and current market activity.

Final Thoughts

Property valuation in Ireland has evolved. Today, accurate valuations depend on local data, recent sales, and smart technology. Understanding how this process works puts you in control, whether you are selling, buying, or simply planning ahead.

Tools like FindQo.ie make property valuation clearer, faster, and more accessible, helping homeowners navigate the Irish property market with confidence.

Frequently Asked Questions

What is property valuation in Ireland?

Property valuation is an estimate of a property’s current market value based on location, condition, recent sales, and buyer demand.

How accurate are online house valuation tools?

When based on recent sales and local data, online valuation tools can provide a reliable value range, especially for early decision making.

Does Eircode affect property valuation?

Yes. Eircode based analysis allows valuations to reflect local market activity rather than broad regional averages.

Is property valuation the same as an asking price?

No. An asking price is a seller’s target, while a valuation reflects what the market is likely to pay.

Can I use a free valuation before selling my home?

Yes. Tools like the FindQo.ie Property Valuation Calculator are ideal for understanding value before speaking to an agent.